How to Record Employee Retention Credit in General Ledger?

As an employer, one of the most important investments you can make is in the retention of your employees. Retention of key staff is essential to the success of your business, and if you are not taking the necessary steps to retain your employees, you could be missing out on valuable opportunities. Recording employee retention credit in your general ledger is one of the best ways to ensure that your employees are receiving the appropriate benefits and incentives. In this article, we will explore how to record employee retention credit in your general ledger, and the potential benefits that come with doing so.

Source: cloudfront.net

Recording Employee Retention Credit in General Ledger

- Step 1: Calculate the amount of Employee Retention Credit (ERC) available.

- Step 2: Create an account in the general ledger for the ERC.

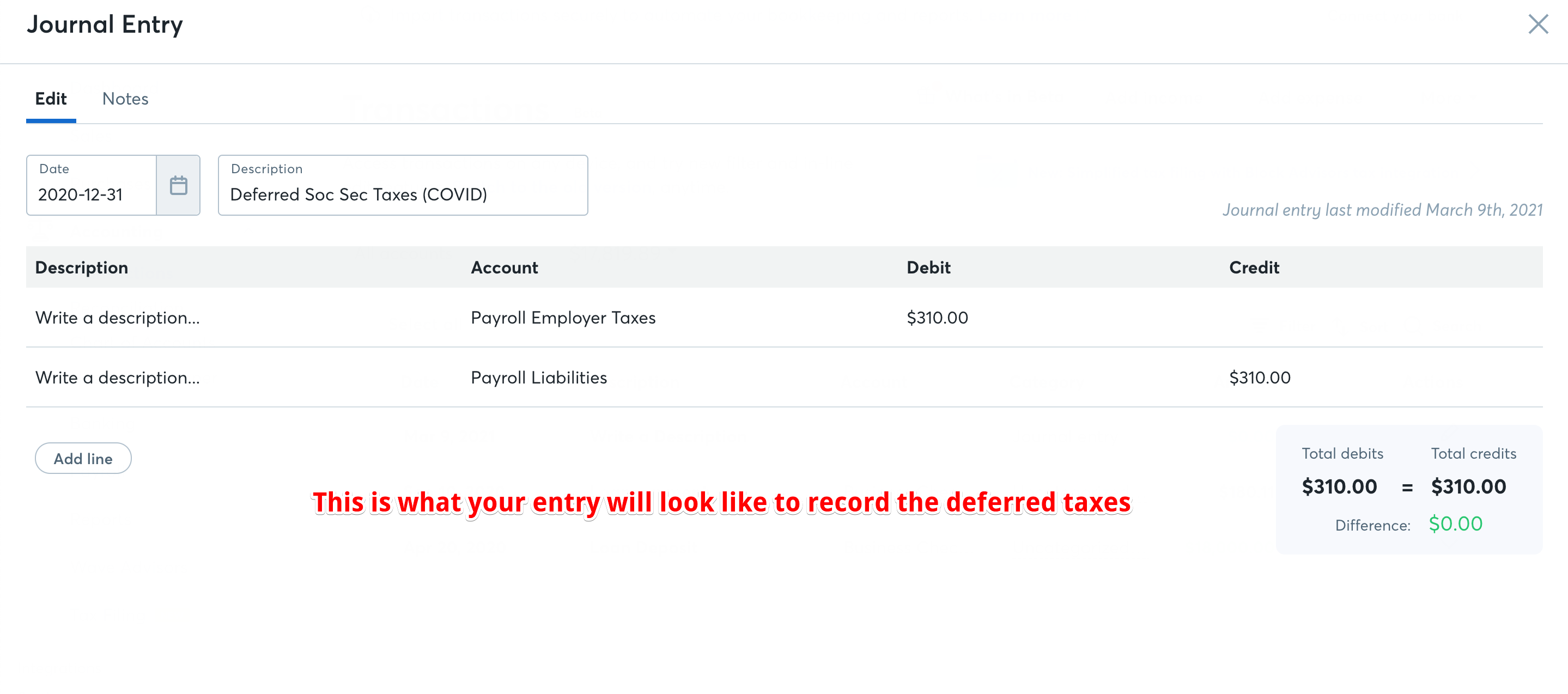

- Step 3: Set up a journal entry to track the ERC.

- Step 4: Record the ERC in the journal entry.

- Step 5: Post the journal entry to the general ledger.

- Step 6: Update the account balance in the general ledger.

What is the Employee Retention Credit?

The Employee Retention Credit (ERC) is a refundable tax credit for employers who keep employees on their payroll during the COVID-19 pandemic. The credit covers 50% of the first $10,000 in wages paid to each employee in 2020. It was introduced as part of the Coronavirus Aid, Relief and Economic Security (CARES) Act, signed into law in March 2020. The ERC is designed to incentivize employers to keep employees on their payroll and to help them cover the costs of doing so. It is available to businesses that have experienced a full or partial suspension of operations due to COVID-19 or have experienced a significant decline in gross receipts.How to Calculate the ERC

The ERC is calculated by multiplying the qualified wages paid to each employee by 50%. This amount is then multiplied by the employer's applicable tax rate. To be eligible for the ERC, the employer must have employed the same number of employees in 2020 as in 2019. The maximum amount of the credit is $5,000 per employee. This means that to qualify for the full credit, a business must pay each employee at least $10,000 in wages during the year. The credit is available to employers of all sizes, including those with 500 or more employees.How to Record the ERC in the General Ledger

The ERC should be recorded in the general ledger as an expense, as it is a cost associated with keeping employees on the payroll. The amount of the credit should be recorded on the income statement and then credited to the balance sheet as a reduction in the payroll expense. When recording the ERC in the general ledger, it is important to note that the credit is only available for the wages paid during the period between March 13, 2020 and December 31, 2020. Any wages paid after December 31, 2020 are not eligible for the ERC.How to Claim the ERC

To claim the ERC, employers must fill out and submit Form 941-X to the IRS. The form must be filed by the due date of the employer's quarterly tax return. Employers can also claim the credit on their annual tax return.How to Report the ERC on Financial Statements

The ERC should be reported on the income statement as a reduction in payroll expense. This will result in a decrease in the employer's tax liability, which should be reflected in the financial statements. The amount of the credit should also be reported in the footnotes to the financial statements.What are the Limitations of the ERC?

The ERC is only available for wages paid between March 13, 2020 and December 31, 2020. Any wages paid after December 31, 2020 are not eligible for the credit. Additionally, the credit is only available for wages paid to employees who are employed for the entire 2020 tax year. The ERC is also limited to the first $10,000 of wages paid to each employee. This means that employers will not be able to take advantage of the full credit if they pay their employees more than $10,000 in wages in 2020.Related FAQ

What is Employee Retention Credit?

Employee Retention Credit (ERC) is a refundable tax credit established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The purpose of the ERC is to help employers keep their employees on payroll even when their operations are suspended or significantly limited due to the Covid-19 pandemic. Eligible employers can receive up to $5,000 per employee in tax credits for wages paid from March 13, 2020 through December 31, 2020.What is the Eligibility Criteria for Employee Retention Credit?

Eligible employers must have suspended or significantly limited their operations due to the Covid-19 pandemic, or have experienced a significant decline in gross receipts. The employer must have been in operation on March 12, 2020 and must have been paying qualified wages to employees. Qualified wages are wages paid to an employee between March 13, 2020 and December 31, 2020, which are subject to federal income tax withholding and Social Security, Medicare, and railroad retirement taxes.How to Record Employee Retention Credit in General Ledger?

When recording the Employee Retention Credit in the general ledger, it should be recorded as a credit to the payroll account and a debit to the employer’s tax payable account. The credit should be recorded for the amount of the credit that is expected to be received by the employer, as the actual amount may vary depending on the actual wages paid.What are the Documentation Requirements for Employee Retention Credit?

Employers must keep records of the wages paid, including payroll tax forms, invoices, and other documents. Employers must also keep a record of the total amount of qualified wages paid, the amount of the credit claimed, and the amount of the credit refunded.How to Calculate the Employee Retention Credit?

The amount of the Employee Retention Credit that an employer can claim is equal to the lesser of (1) 50% of the qualified wages paid to each employee, or (2) $5,000 per employee. The maximum amount of the credit is $5,000 per employee, and the total amount of the credit is limited to $15,000 per employer.How to Claim the Employee Retention Credit?

Employers can claim the Employee Retention Credit on their quarterly federal employment tax returns (Form 941). Employers can also request an advance payment of the credit by filing Form 7200 with the IRS. The IRS will then issue a refund to the employer for the amount of the credit.How to File your 2020 Tax Return with the Employee Retention Credit

To conclude, recording employee retention credit in the general ledger is a crucial step in your overall financial management process. By understanding the correct procedures and taking the time to accurately document the details, you can ensure that your business remains compliant and that your financial records remain up-to-date. With the right approach, you can help minimize employee turnover and maximize your organization's financial success.

Tags:

Previous post

How to Fill Out a 941x for Employee Retention Credit?

Next post