ERC Tax Credit 2023: Is the ERC tax credit still available?

The ERC tax credit has been a valuable tax break for businesses since its inception in 2003. With the end of the year quickly approaching, it's important to know whether the ERC tax credit is still available in 2023. In this article, we'll take a look at the current status of the ERC tax credit, as well as the potential changes that could be in store for this popular tax break. Whether you're a business owner or a tax professional, understanding the ERC tax credit can help you maximize the amount of money you save on taxes.

Source: lendio.com

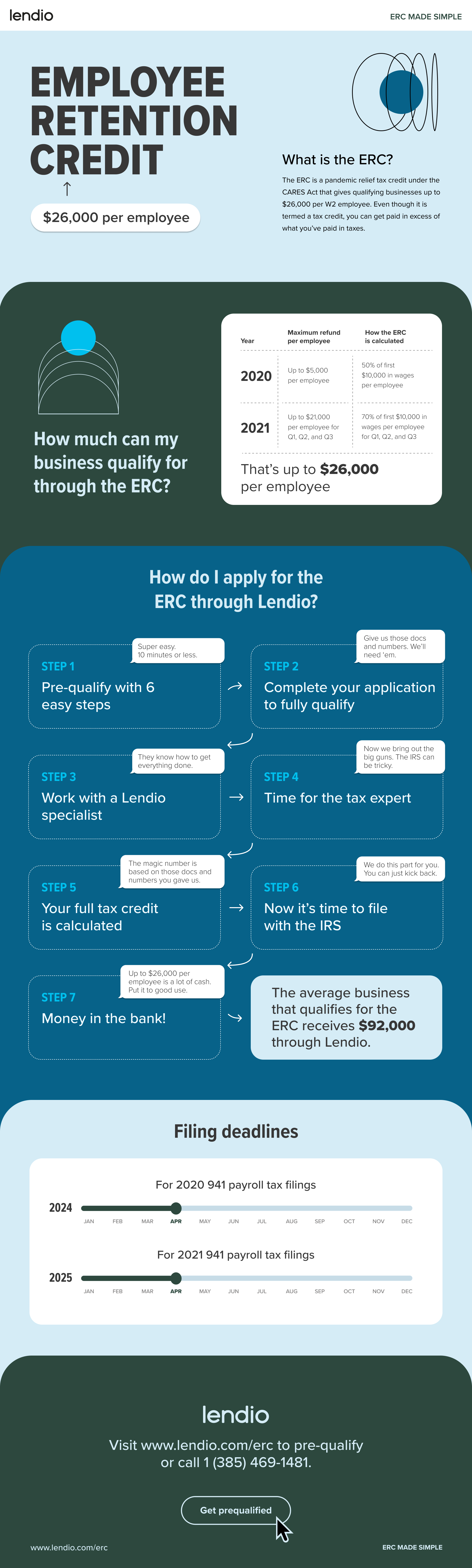

Source: oregonrla.org

The ERC Tax Credit is still available for small businesses in 2021. Businesses may be able to receive a credit of up to $5,000 for the costs of providing paid family and medical leave to their employees. Eligibility requirements and other details of the credit can be found on the IRS website.

ERC Tax Credit 2023: Is the ERC Tax Credit Still Available?

The Energy Efficiency and Renewable Energy Tax Credit (ERC) is a tax break that was created as part of the American Recovery and Reinvestment Act of 2009. The ERC provides a tax credit of up to $1,500 for consumers who make qualifying energy efficiency and renewable energy improvements to their homes. The ERC was set to expire at the end of 2021, but was recently extended through the end of 2023. This means that the ERC is still available for those who are looking to make energy efficiency and renewable energy improvements to their homes.What Qualifies for the ERC Tax Credit?

The ERC tax credit is available for a wide variety of energy efficiency and renewable energy improvements. These improvements include, but are not limited to, installing energy efficient windows, doors, insulation, water heaters, air conditioners, and furnaces. Additionally, the ERC tax credit also applies to certain solar energy systems, geothermal heat pumps, small wind turbines, and fuel cells. In order to qualify for the ERC tax credit, the product or system must be certified by the manufacturer as meeting the standards set forth by the Internal Revenue Service. Additionally, the improvements must be made to an existing home, and the home must be the primary residence of the taxpayer.How Much is the ERC Tax Credit Worth?

The ERC tax credit is worth up to $1,500, depending on the type of improvements made. For example, solar energy systems are eligible for a tax credit of up to 30% of the cost of the system, up to a maximum of $1,500. Geothermal heat pumps, small wind turbines, and fuel cells are eligible for a tax credit of up to 30% of the cost, up to a maximum of $500. Energy efficient windows, insulation, water heaters, air conditioners, and furnaces are eligible for a tax credit of 10% of the cost, up to a maximum of $500.How to Claim the ERC Tax Credit?

In order to claim the ERC tax credit, the taxpayer must fill out Form 5695 and submit it with their tax return. The form must include documentation showing that the improvements meet the requirements set forth by the IRS. Additionally, the taxpayer must keep all receipts and invoices for the improvements for at least three years after the due date of the return.Are There Any Limitations to the ERC Tax Credit?

Yes, the ERC tax credit does have a few limitations. First, the credit is only available for improvements made to a primary residence. Additionally, the credit is only available for improvements made in 2021, 2022, or 2023. Finally, the credit is only available for taxpayers with an adjusted gross income of less than $80,000 for individuals and $160,000 for married couples filing jointly.What Other Tax Credits Are Available?

In addition to the ERC tax credit, there are a number of other tax credits available for energy efficiency and renewable energy improvements. These credits include the Residential Energy Efficient Property Credit, the Solar Investment Tax Credit, the Fuel Cell Tax Credit, and the Residential Renewable Energy Tax Credit. To learn more about these credits and how they can help you save on your taxes, you should consult a tax professional.Related FAQ

What is the ERC Tax Credit?

The ERC Tax Credit, or the Employer Retention Credit, is a federal tax credit that was created by the Coronavirus Aid, Relief and Economic Security (CARES) Act of 2020. The credit is designed to help employers retain their employees during the COVID-19 pandemic by providing them with a tax credit equal to 50% of up to $10,000 in wages per employee.Is the ERC tax credit still available?

Yes, the ERC tax credit is still available for 2021 and has been extended through December 31, 2023. The credit has been expanded to cover up to 80% of wages paid per employee, up to a maximum of $7,000 per employee.Who is eligible for the ERC Tax Credit?

The ERC Tax Credit is available to employers who have experienced a decrease in revenues of 20% or more in a calendar quarter compared to the same quarter in 2019. Additionally, employers must have had operations in the United States in 2020, and either paid wages to employees or had operations fully or partially suspended due to government orders related to COVID-19.How do employers claim the ERC Tax Credit?

The ERC Tax Credit can be claimed on Form 941, Employer’s Quarterly Federal Tax Return. Employers will need to provide information about their total wages paid and the amount of the ERC tax credit they are claiming.What are the limitations of the ERC Tax Credit?

The ERC Tax Credit is limited to 80% of wages paid per employee, up to a maximum of $7,000 per employee. Additionally, employers must reduce their wages paid to their employees by the amount of their ERC Tax Credit or they may not qualify for the credit.What other resources are available to employers?

In addition to the ERC Tax Credit, there are several other resources available to employers to help them during the COVID-19 pandemic. These include the Paycheck Protection Program, the Employee Retention Credit, the Families First Coronavirus Response Act, and the Coronavirus Economic Stabilization Act. Employers should consult their tax advisors to determine which of these resources is best suited to their needs.

ERC 2023 Update: Still Available! Refund = $26,000 Per Employee (Employee Retention Credit) ERTC

The ERC tax credit is still available for 2023 and can be a great way to lower your taxes. If you're eligible for the ERC, it can provide an excellent tax break and help you maximize your deductions. Ultimately, the decision whether to take advantage of the ERC tax credit is up to you. Make sure to do your research and consult with a professional tax preparer to ensure that you make the right decision for your financial situation.

Tags:

Previous post

Small businesses struggle with ERC tax credit submissions

Next post