How to Calculate Erc Credit With Ppp?

Are you a small business owner trying to understand how the Paycheck Protection Program (PPP) affects your earned income credit (EIC)? Calculating your EIC with PPP can be confusing and overwhelming. But it doesn't have to be! In this article, we'll walk you through the process step-by-step to help you understand how to calculate your EIC when you've received a PPP loan. We'll cover topics such as the PPP benefits and how it impacts your EIC, the differences between the EIC and PPP, and the steps you can take to properly calculate your EIC with PPP. So whether you're a new business owner or a seasoned veteran, you'll have the knowledge you need to make the most of your EIC and PPP benefits.

Source: ytimg.com

Source: gusto.com

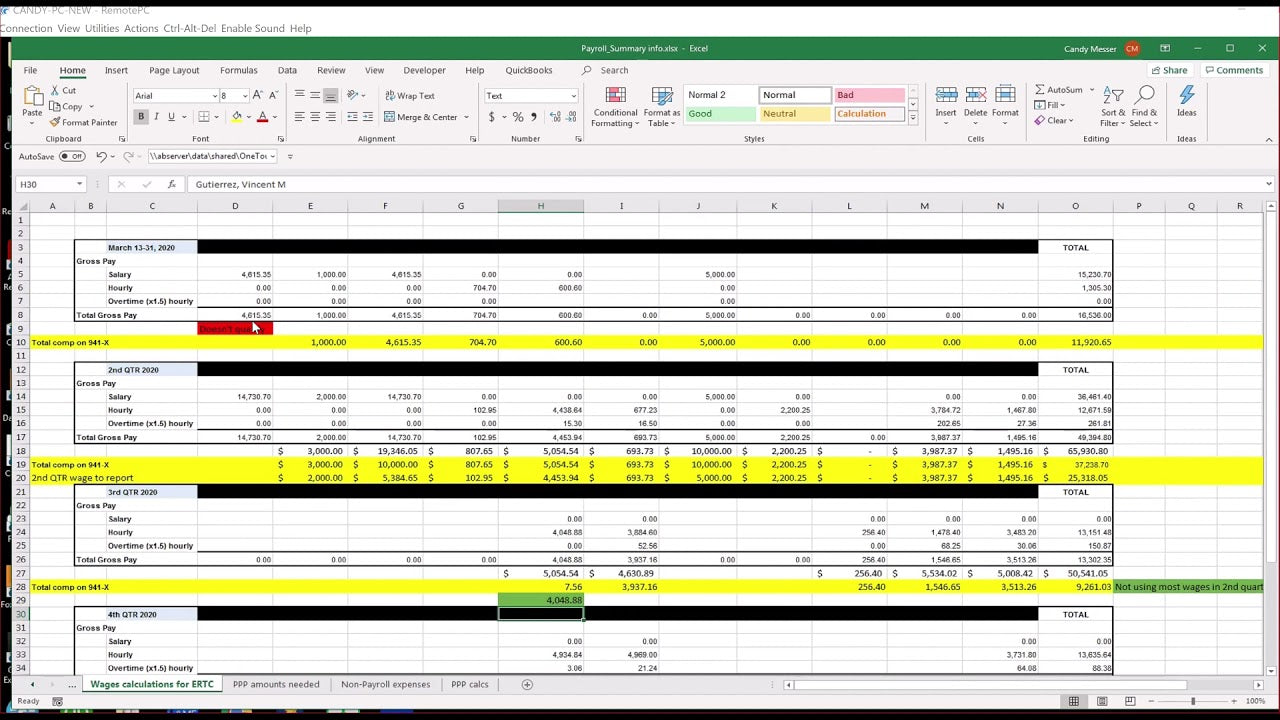

Calculating ERC Credit with PPP: ERC Credit with PPP can be calculated by using the PPP formula. The formula is: ERC = (Gross Payroll Costs/Average Monthly Payroll Costs) x 2.5. The Gross Payroll Costs are the total costs of wages, tips, benefits and employer contributions. The Average Monthly Payroll Costs are the average amount of wages, tips, benefits and employer contributions over a period of twelve months. To calculate ERC Credit, you must first determine the Gross Payroll Costs and then divide by the Average Monthly Payroll Costs. Then multiply the result by 2.5 to get the ERC Credit.

Calculating ERC Credit with PPP: A Step-by-Step Guide

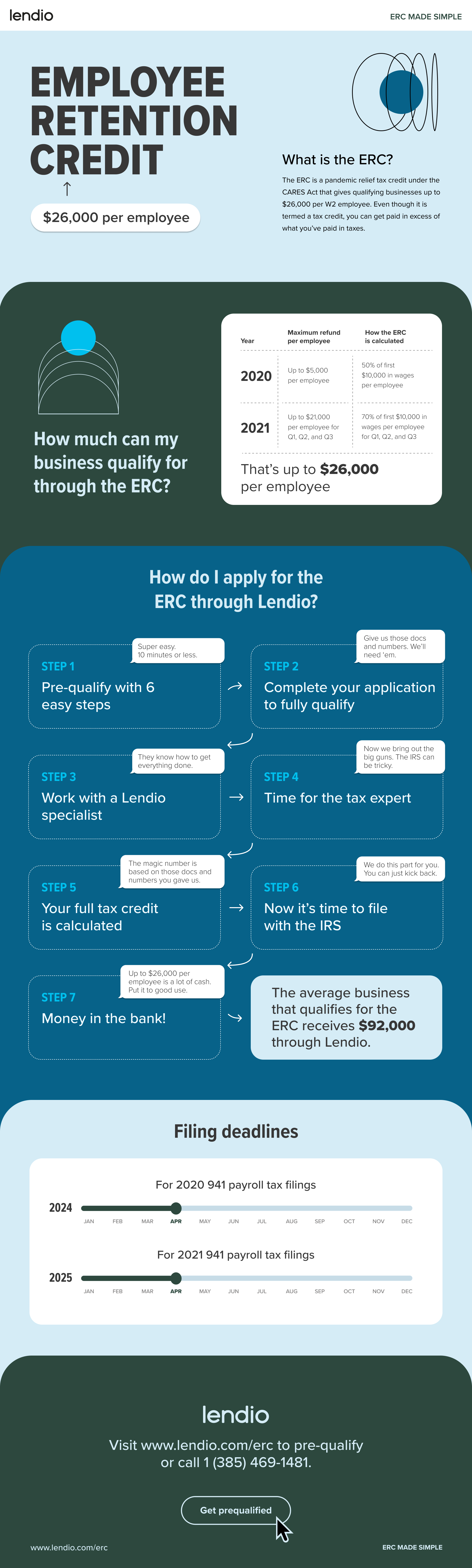

The Paycheck Protection Program (PPP) is a loan forgiveness program that allows individuals and businesses to recover some of the economic losses they experienced during the COVID-19 pandemic. PPP loans are administered by the Small Business Administration (SBA) and are available to both small businesses and self-employed individuals. However, many businesses are not aware that they may also be eligible for the Employee Retention Credit (ERC) for qualified wages paid during the crisis. This article will explain how to calculate ERC credit with PPP.Understanding the Basics of ERC Credit

The Employee Retention Credit (ERC) is a refundable tax credit for employers who have experienced a full or partial suspension of their operations due to the COVID-19 pandemic. It is available to employers who have experienced a decline in gross receipts of 50% or more compared to the same quarter in the previous year. Employers can claim the ERC for qualified wages paid to employees between March 12, 2020, and December 31, 2020. The maximum amount of the credit is $5,000 per employee, per quarter.Calculating Eligibility for ERC Credit

To be eligible for the ERC, employers must first determine whether they have experienced a decline in gross receipts of 50% or more compared to the same quarter in the previous year. This can be done by comparing the gross receipts of the current quarter to the same quarter in the prior year. If the gross receipts for the current quarter are 50% or less than the same quarter in the previous year, the employer is eligible for the ERC.Calculating the Amount of the Credit

Once the employer has determined that they are eligible for the ERC, they must then calculate the amount of the credit they are eligible for. The credit is equal to 50% of the qualified wages paid to employees during the crisis, up to $5,000 per employee, per quarter. The employer must also subtract any credits received through the PPP from the total amount of the ERC.Claiming the Credit

Once the employer has calculated the amount of the credit, they can claim it on their taxes. The credit is claimed on IRS Form 941. The employer must also provide documentation to support the claim, such as payroll records and copies of the PPP loan application.Conclusion

The Employee Retention Credit (ERC) is a refundable tax credit for employers who have experienced a full or partial suspension of their operations due to the COVID-19 pandemic. Employers can calculate their eligibility and the amount of the credit by comparing their gross receipts to the same quarter in the previous year and subtracting any credits received through the PPP. The credit is then claimed on their taxes, using IRS Form 941.Few Frequently Asked Questions

What is ERC Credit?

ERC Credit stands for Environmental Responsibility Credit. It is a type of credit given to businesses that take steps to foster sustainability and reduce their environmental impact. This type of credit is offered by many governments and organizations in order to incentivize companies to adopt green practices. This can include purchasing renewable energy sources, reducing waste, and/or investing in energy efficiency measures.What is PPP?

PPP stands for Purchasing Power Parity. It is an economic measure used to compare the purchasing power of different countries. PPP takes into account the cost of goods, services, and wages in different countries. It is used to compare different countries’ living standards and economic development.How is ERC Credit Calculated with PPP?

ERC Credit is calculated with PPP by taking into account the cost of goods, services, and wages in different countries and determining the environmental responsibility of each country. The PPP value is then multiplied by a number that is based on the country’s environmental practices. This number is a measure of how much a country is doing to promote sustainability and reduce its environmental impact.What Factors are Used to Calculate ERC Credit with PPP?

The factors used to calculate ERC Credit with PPP include the cost of goods, services, and wages in different countries, as well as the country’s environmental practices. This can include the amount of renewable energy sources used, waste reduction measures, and investment in energy efficiency.What are the Benefits of Calculating ERC Credit With PPP?

Calculating ERC Credit with PPP can help to incentivize businesses to adopt green practices. This can help reduce their environmental impact and promote sustainability. It can also help to compare different countries’ living standards and economic development.Where Can I Find More Information on Calculating ERC Credit with PPP?

You can find more information on calculating ERC Credit with PPP from various organizations, such as the World Bank or the International Monetary Fund. Additionally, many governments have specific guidelines and programs in place that can provide more information on how to calculate ERC Credit with PPP.

ERTC Calculator & Calculation Spreadsheet for the Employee Retention Credit with PPP Coordination

Calculating ERC credit with PPP can be a daunting task. With the right knowledge, understanding, and tools, however, it can be done. By understanding the importance and mechanics of the PPP loan program, businesses can get the most out of their ERC credit. With a better understanding of ERC credit, businesses can make sure they are taking full advantage of the program to maximize their savings and support their recovery.

Tags:

Previous post

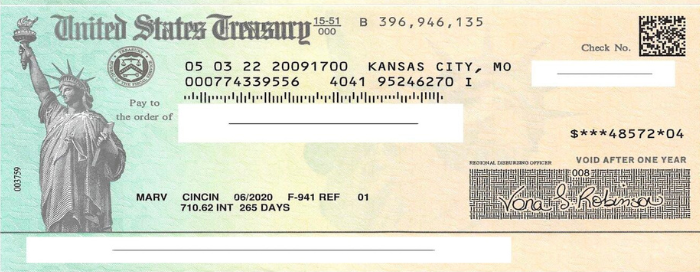

When Will Employee Retention Credit Checks Be Mailed?

Next post