How to Fill Out a 941x for Employee Retention Credit?

Filling out a 941x form can be a complicated and time consuming process. If you are an employer in need of the employee retention credit, understanding the process and filing the 941x form correctly is essential. In this article, we will provide a step-by-step guide on how to fill out the 941x form correctly, helping you to take advantage of the employee retention credit and save your business money.

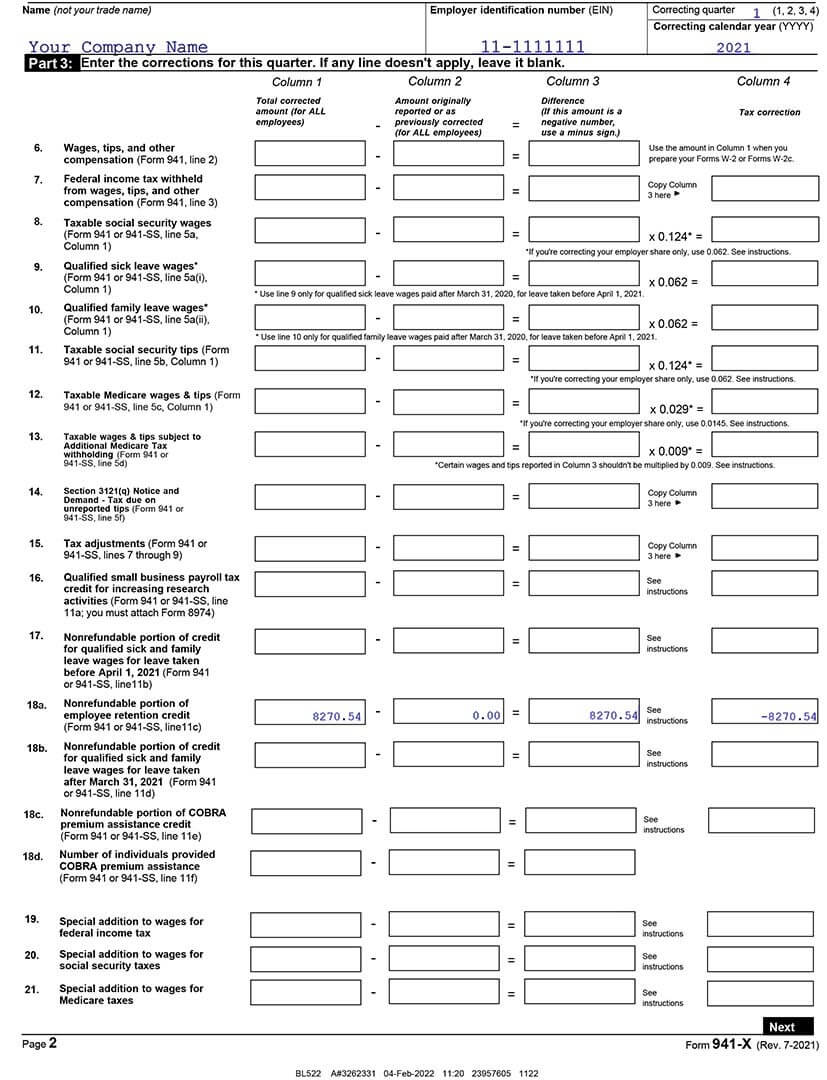

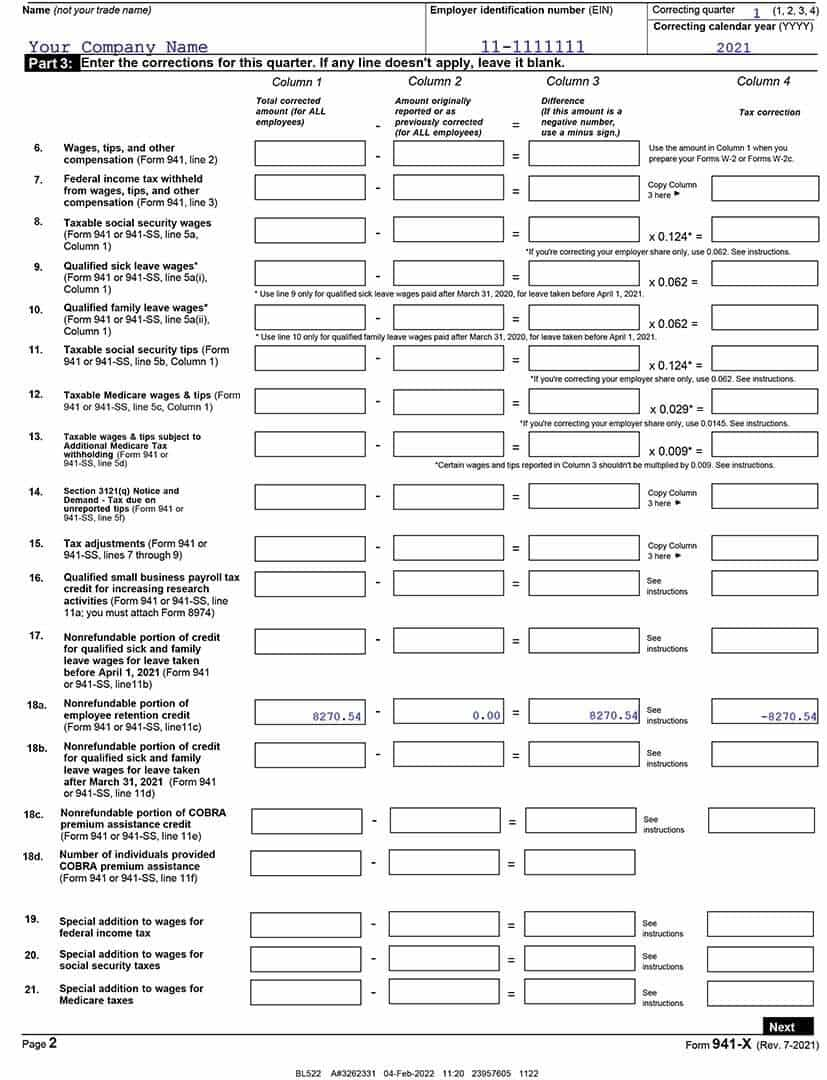

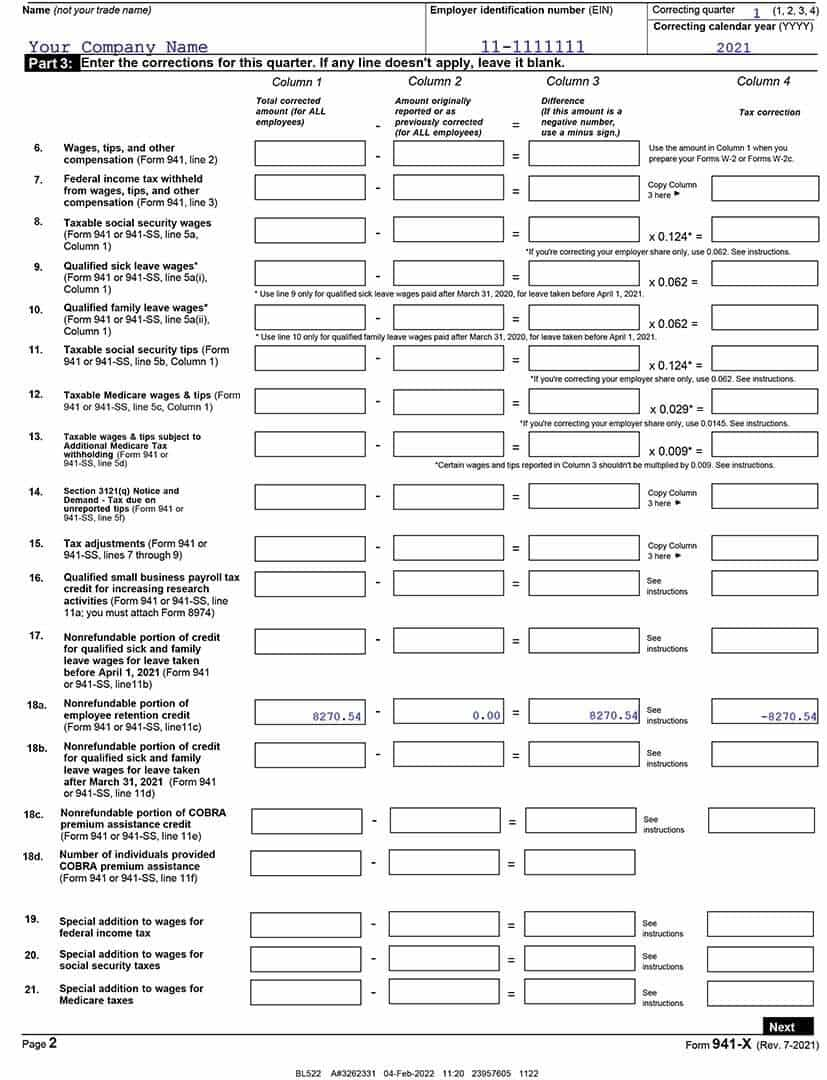

Source: hubspotusercontent-na1.net

How to Prepare Form 941-X

In conclusion, filing Form 941x for Employee Retention Credit is a simple process that can help businesses save money. With the proper knowledge and guidance, you can complete the form quickly and easily. Remember to do your research and consult a professional if you have any questions or concerns. By taking the necessary steps to properly file your Form 941x, you will be able to maximize your savings and benefit from the employee retention credit.

Filing Form 941-X for Employee Retention Credit:

- Start by downloading and filling out Form 941-X, which is the amended version of Form 941.

- Enter the employer’s name, number, and address in Part 1.

- In Part 2, fill out the number of employees and the wages paid.

- In Part 3, enter the amount of the refundable credit that you are claiming.

- In Part 4, enter the amount of the adjustments from the original Form 941.

- Sign and date the form in Part 5.

- Mail the completed Form 941-X to the IRS.

Overview of How to Fill Out a 941x for Employee Retention Credit

The Employee Retention Credit (ERC) is a refundable tax credit for employers subject to closure due to COVID-19, or experiencing a significant decline in gross receipts. Employers can claim the ERC by filing Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. This article will provide a step-by-step guide on how to fill out Form 941-X for the ERC.Step 1: Enter Basic Business Information

The first step in filing Form 941-X is to enter your basic business information. This includes your Employer Identification Number (EIN), the name of your business, the address of your business, and the tax period for which the credit is being claimed.Form 941-X

Form 941-X is a form used to make adjustments to an employer’s quarterly federal tax return. This form is used to claim the ERC, as well as any other adjustments that may need to be made to the employer’s quarterly tax return.Employer Identification Number (EIN)

The Employer Identification Number (EIN) is a nine-digit number assigned by the Internal Revenue Service (IRS) to identify your business for tax purposes. This number should be entered on Form 941-X, as it is required for claiming the ERC.Name and Address

The name and address of your business should be entered as it appears on your quarterly tax return. This information is used to ensure that the credit is applied to the correct business.Step 2: Calculate the Amount of Credit

The next step in filing Form 941-X is to calculate the amount of credit you are eligible to claim. The amount of the credit depends on several factors, including the number of employees you have and the amount of wages paid to these employees.Eligible Employers

To be eligible for the ERC, employers must have been subject to closure due to COVID-19 or have experienced a significant decline in gross receipts. This means that employers must have been partially or fully closed due to governmental orders related to the COVID-19 pandemic, or have experienced a decline in gross receipts of at least 50% compared to the same quarter in the prior year.Calculation of Credit

The amount of the credit can be calculated by multiplying the eligible wages paid to employees in a quarter by 50%. The maximum amount of credit that can be claimed for any quarter is $5,000 per employee. This means that the maximum credit that can be claimed for any quarter is $5,000 multiplied by the number of employees.Step 3: File Form 941-X

The final step in filing Form 941-X is to file the form with the IRS. To do this, you must complete the form and attach any required documents. Once the form is completed, you can mail it to the IRS or submit it electronically.Required Documentation

When filing Form 941-X, you must attach certain documents to the form. These include copies of your quarterly Form 941, along with any other documents that are needed to support the claim for the ERC.Electronic Filing

Form 941-X can be filed electronically using the IRS e-file system. This system allows employers to submit their forms and documents electronically. The e-file system is secure and easy to use, and it can save time and money compared to filing the forms by mail.Top 6 Frequently Asked Questions

What is the 941x Form?

The 941x form is an IRS form commonly used for adjusting payroll tax, including the Employee Retention Credit (ERC). The form is used to make corrections to the previously filed Form 941, Employer's Quarterly Federal Tax Return. It includes information such as the employee's wages, any adjustments, and the amount of ERC the employer is claiming.Who Can Claim the Employee Retention Credit?

The Employee Retention Credit is available to employers whose businesses have been impacted by the COVID-19 pandemic. Specifically, employers whose businesses have experienced either a full or partial suspension of operations due to a government order or have experienced a significant decline in gross receipts can claim the credit.When Do I Need to File the 941x?

The 941x form must be filed by the employer when claiming the Employee Retention Credit. Generally, the form should be filed with the IRS within three months of the end of the quarter for which the credit is being claimed.What Information Do I Need to Fill Out the 941x?

When filling out the 941x form, employers need to provide information about the wages paid to their employees and any adjustments to the wages. Additionally, employers will need to provide information about the amount of ERC they are claiming.Where Do I Send the 941x?

The 941x form should be mailed to the appropriate IRS address. Generally, employers should mail the form to the address on the return they received when they initially filed Form 941.Can I E-File the 941x?

Yes, employers can e-file the 941x form. To do so, employers must use the IRS's Electronic Filing System. Employers must have an E-File account with the IRS in order to e-file the form.How to Prepare Form 941-X Step-by-Step $26,000 Per Employee Retention Tax Credit #erc

In conclusion, filing Form 941x for Employee Retention Credit is a simple process that can help businesses save money. With the proper knowledge and guidance, you can complete the form quickly and easily. Remember to do your research and consult a professional if you have any questions or concerns. By taking the necessary steps to properly file your Form 941x, you will be able to maximize your savings and benefit from the employee retention credit.

Articolo precedente

How Do I Record Employee Retention Credit in Quickbooks?

Prossimo articolo