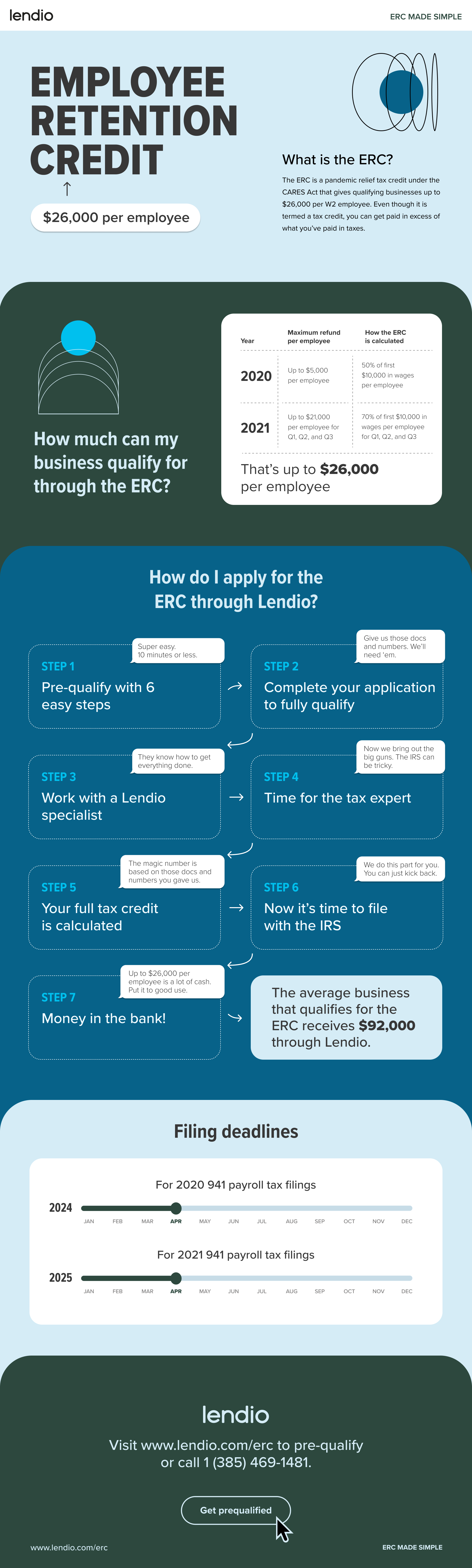

How to Calculate Monthly Loan Payment in Excel?

Do you need help with calculating your monthly loan payments in Excel? If yes, then you have come to the right place. In this article, you will learn the step-by-step process on how to calculate your monthly loan payments in Excel. With this knowledge, you will be able to accurately track and manage your loan payments, and ensure that you are always up-to-date on your financial obligations. So, let’s dive right into it and get started!

How to Calculate Monthly Loan Payment in Excel?

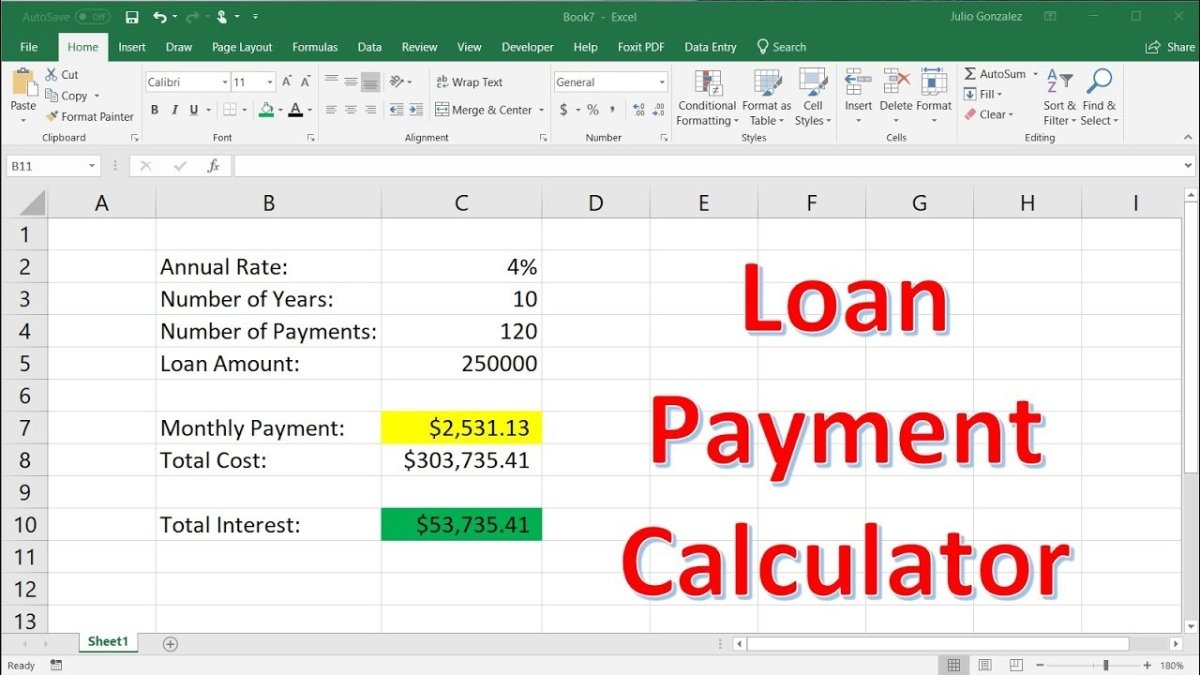

- Open a new Excel document and make sure you are in the Home tab.

- Click the “Formulas” tab on the top menu bar.

- Select “Financial” from the drop-down list.

- Click on “PMT” to open the function box.

- In the “PMT” box, enter the loan amount, annual interest rate, and the loan term in years.

- Click “OK” to calculate the loan payment.

- The monthly loan payment will be displayed in the cell you selected.

Understanding Monthly Loan Payments in Excel

The monthly loan payment is a repayment plan for a loan taken out over a period of time. This payment plan is usually determined by the lender and agreed upon by the borrower. It is important to understand how to calculate your monthly loan payments in excel so you can make informed decisions when taking out a loan. In this article, we will discuss the basics of calculating monthly loan payments in excel as well as tips and tricks for making the most of your loan payments.

The first step to understanding how to calculate monthly loan payments in excel is to know the different types of loan repayment plans. There are several different types of loan repayment plans available, such as the fixed-rate loan, the adjustable-rate loan, and the balloon loan. Each of these types of loans has different terms and conditions that affect the monthly payment amount. It is important to understand the terms and conditions of the loan before making a decision.

The next step is to determine the loan amount and the repayment period. The loan amount will determine the monthly payments and the repayment period will determine how long the loan will last. Once these two factors are determined, you can then calculate the monthly loan payment using excel. The formula for calculating monthly loan payments is: monthly payment = (principal amount + interest rate) / number of payments per year.

Using the Loan Payment Formula in Excel

Calculating your monthly loan payments in excel is a fairly straightforward process. First, you need to enter the loan amount, the repayment period, and the interest rate into the appropriate columns. Once this information is entered, you can use the loan payment formula to calculate the monthly payment amount. You can customize the formula to include additional factors such as principal amount, interest rate, and repayment period.

The next step is to enter the loan amount and the repayment period into the formula. The formula will then calculate the monthly payment amount. After the calculation is complete, you can enter the monthly payment amount into the appropriate column. This will give you a clear picture of how much you will be paying each month.

Tips for Calculating Monthly Loan Payments in Excel

When calculating monthly loan payments in excel, it is important to keep a few tips in mind. First, make sure to enter the loan amount, repayment period, and interest rate accurately. If any of these figures are incorrect, the calculation will not be accurate. Additionally, it is important to remember to include any additional fees or charges that may be associated with the loan. This will ensure that you have an accurate and comprehensive understanding of your monthly payments.

Using Excel to Track Your Loan Payments

When calculating monthly loan payments in excel, it is also beneficial to use the software to track your payments. This will allow you to easily monitor the progress of your loan and make sure that your payments are being made on time. Additionally, you can use the software to set up automatic payments so that you don’t have to worry about forgetting to make a payment. This can help you stay on top of your loan and make sure that you are meeting your repayment obligations.

Understanding Your Loans in Excel

It is important to understand how to calculate monthly loan payments in excel so that you can make informed decisions when taking out a loan. By using the loan payment formula and tracking your payments, you can ensure that you are making the most of your loan. Additionally, understanding the terms and conditions of your loan will help you make sure that you are getting the best deal possible. With the right knowledge, you can use excel to ensure that you are making the best decisions for your financial future.

Few Frequently Asked Questions

Question 1: What is a Monthly Loan Payment?

A monthly loan payment is the amount of money that you must pay to your lender each month in order to pay off your loan. The amount of the payment will depend on the size of the loan and the amount of interest you have agreed to pay. It may also include other costs such as insurance premiums or fees.

Question 2: What Information is Needed to Calculate a Monthly Loan Payment?

In order to calculate a monthly loan payment, you will need to know the size of the loan, the length of the loan (in months or years), and the interest rate that applies to the loan. You may also need to know any additional costs associated with the loan, such as insurance premiums or fees.

Question 3: How Do I Calculate a Monthly Loan Payment in Excel?

In order to calculate a monthly loan payment in Excel, you will need to use the PMT function. This function requires the user to enter the size of the loan, the length of the loan (in months or years), and the interest rate that applies to the loan. It will then calculate the total monthly payment.

Question 4: What Are the Steps to Calculate a Monthly Loan Payment in Excel?

The steps to calculate a monthly loan payment in Excel are as follows:

1. Enter the size of the loan, the length of the loan (in months or years), and the interest rate that applies to the loan into the PMT function.

2. Enter the additional costs associated with the loan, such as insurance premiums or fees, if necessary.

3. The PMT function will then calculate the total monthly payment.

Question 5: How Can I Use the PMT Function to Calculate a Monthly Loan Payment?

The PMT function in Excel can be used to calculate a monthly loan payment. To use the function, enter the size of the loan, the length of the loan (in months or years), and the interest rate that applies to the loan. The function will then calculate the total monthly payment.

Question 6: What Are the Limitations of the PMT Function?

The PMT function in Excel is limited to calculating a monthly loan payment. It does not provide information on other aspects of a loan, such as the total interest paid over the life of the loan or the total amount repaid. It also does not take into account any additional costs associated with the loan.

How to calculate monthly loan payments in excel

Calculating the monthly payments of a loan is an important skill to have for managing personal finances. With Excel, the calculation process is made simple and efficient. By learning the steps on how to calculate a monthly loan payment in Excel, you can save yourself time and energy in the long run. With Excel, you can easily manage your loans and keep track of your payment progress.