When Does the Employee Retention Credit Expire?

Employee retention is a major concern for employers today, especially during the uncertain times of the pandemic. To help businesses retain their valuable employees, the U.S. government introduced the Employee Retention Credit (ERC). But with the ever-changing landscape of federal tax credits, it can be difficult to keep track of when this credit is set to expire. This article will explore when the Employee Retention Credit is set to expire and the implications of not taking advantage of this tax credit.

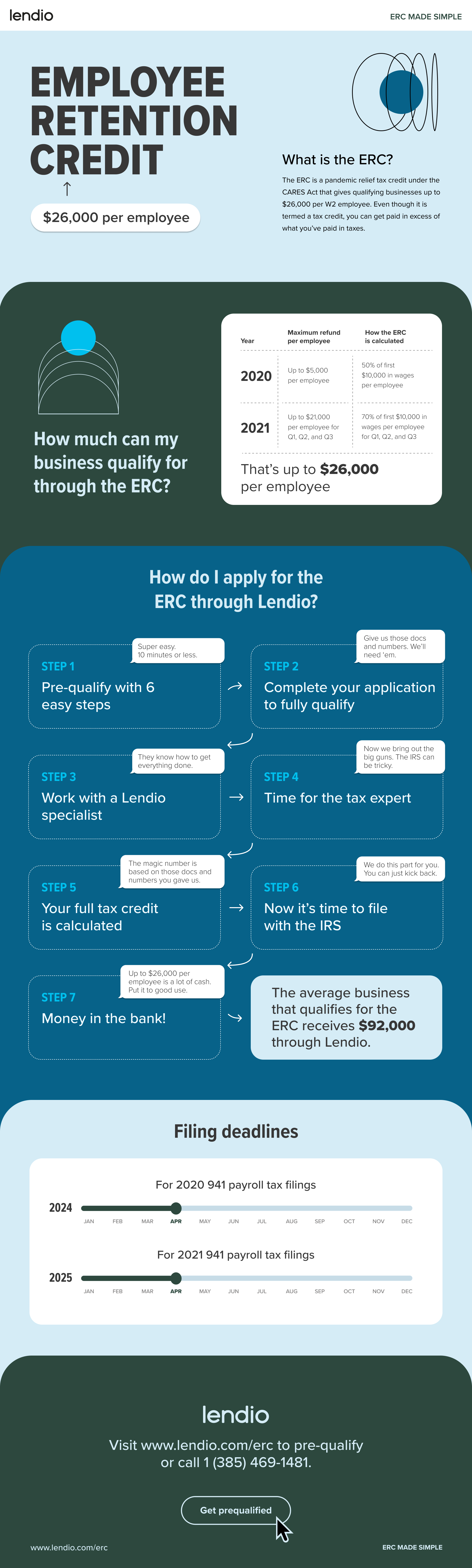

The Employee Retention Credit (ERC) expires on December 31, 2021. This credit was created as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act to incentivize businesses to keep their employees on the payroll. The credit is a refundable tax credit of up to $5,000 per employee. To qualify for the credit, employers must meet certain criteria, such as experiencing a decline in gross receipts or fully or partially suspending operations due to a COVID-19 related shut down.

What is the Employee Retention Credit and When Does it Expire?

The Employee Retention Credit is a refundable tax credit that can be claimed by employers who paid qualified wages to employees during the COVID-19 pandemic. The credit, which was created by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, provides a refundable tax credit of up to $5,000 per employee. The credit is available for wages paid between March 12, 2020, and December 31, 2020. The Employee Retention Credit is available to employers who had their operations fully or partially suspended due to governmental orders related to COVID-19, or to employers whose gross receipts declined by more than 50% compared to the same quarter in the prior year. The credit is also available to employers who are not otherwise eligible for the credit but whose gross receipts have declined by more than 20%.When Does the Credit Become Available?

The Employee Retention Credit became available to employers on April 1, 2020. Employers are able to claim the credit on their quarterly payroll tax returns. The credit is available for wages paid between March 12, 2020, and December 31, 2020.How Much is the Credit Worth?

The Employee Retention Credit is worth up to $5,000 per employee. The amount of the credit is equal to the lesser of 50% of the wages paid to an employee during the period, or $5,000 per employee. The credit can be claimed for wages paid to employees who are not providing services due to the suspension of operations or due to the decline in gross receipts.Eligibility Requirements for the Employee Retention Credit

In order to be eligible for the Employee Retention Credit, employers must meet certain eligibility requirements. Employers must either have had their operations fully or partially suspended due to governmental orders related to COVID-19, or must have experienced a decline in gross receipts of more than 50% compared to the same quarter in the prior year.Who is Not Eligible for the Credit?

Employers who are not eligible for the credit include: employers receiving Small Business Interruption Loans through the Paycheck Protection Program; employers receiving other grants or credits from the federal government; and employers who are not otherwise eligible for the credit but whose gross receipts have declined by more than 20%.How to Claim the Credit

The Employee Retention Credit is available to employers on their quarterly payroll tax returns. Employers must also provide documentation to support their claim of eligibility for the credit. Documentation must include a statement of the facts and circumstances related to the decline in gross receipts or the suspension of operations.Limitations on the Employee Retention Credit

The Employee Retention Credit is limited to the amount of wages paid by an employer to employees during the period of March 12, 2020, and December 31, 2020. The credit cannot exceed the amount of taxes paid by the employer during the period.Additional Limitations on the Credit

In addition to the limitations on the amount of the credit, there are additional limitations on the credit. The credit cannot be claimed on wages paid to employees after December 31, 2020. The credit also cannot be claimed on wages paid to employees who are not providing services due to the suspension of operations or due to the decline in gross receipts.What Happens If an Employer Cannot Use the Credit?

If an employer is not eligible for the Employee Retention Credit or is not able to use the credit, the employer may be able to take advantage of other tax credits or deductions. These include the Work Opportunity Tax Credit and the Employee Training Tax Credit. Additionally, employers may be eligible for other relief measures, such as payroll tax deferral, unemployment insurance, or the Paycheck Protection Program.Frequently Asked Questions

What is the Employee Retention Credit?

The Employee Retention Credit (ERC) is a refundable tax credit available to certain employers whose operations have been fully or partially suspended due to a government order related to COVID-19, or who experienced a significant decline in gross receipts. The credit is equal to 50% of the qualified wages (up to a maximum of $10,000) paid to employees between March 13, 2020 and December 31, 2020. The credit is available to employers with 500 or fewer employees that either had their operations fully or partially suspended due to a COVID-19 related government order, or experienced a significant decline in gross receipts.How much is the Employee Retention Credit?

The Employee Retention Credit is equal to 50% of qualified wages (up to a maximum of $10,000) paid to employees between March 13, 2020 and December 31, 2020. Qualified wages include wages paid to employees for time not spent working due to full or partial suspension of operations or due to a significant decline in gross receipts.Who is eligible for the Employee Retention Credit?

Employers with 500 or fewer employees that either had their operations fully or partially suspended due to a COVID-19 related government order, or experienced a significant decline in gross receipts, are eligible for the Employee Retention Credit.When Does the Employee Retention Credit Expire?

The Employee Retention Credit expires on December 31, 2020.How do employers claim the Employee Retention Credit?

Employers may claim the Employee Retention Credit by filing Form 941, Employer’s Quarterly Federal Tax Return, and claiming the credit on line 12 of the form. Employers may also claim the credit on their federal income tax return for the taxable year in which the wages were paid or incurred.Are there any other tax benefits available to employers related to the Employee Retention Credit?

Yes, employers may also be eligible for the Paycheck Protection Program (PPP) loan, which provides a forgivable loan to employers that maintain their payroll during the COVID-19 pandemic. Employers may also be eligible for the Work Opportunity Tax Credit, which provides a tax credit to employers who hire individuals from certain target groups, such as veterans and individuals with disabilities. Employers may also be eligible for the Employer Credit for Paid Family and Medical Leave, which provides a tax credit to employers who provide paid family and medical leave to their employees.(ERC) Employee Retention Credit Processing Times - How Long To Get ERC Refund?

The Employee Retention Credit is an incredibly useful tool for employers to help their employees during this unprecedented time. It helps to reduce the financial burden of providing wages to employees and is an important part of helping businesses survive during these trying times. However, businesses must be aware that the Employee Retention Credit is only available for a limited period of time and will expire on December 31st, 2020. Therefore, it is essential for employers to take advantage of this credit as soon as possible in order to maximize its potential benefit.

Balises:

Article précédent

When Will Employee Retention Credit Checks Be Mailed?

Article suivant