How to Check Status of Employee Retention Credit?

Are you an employer wondering how to check the status of your employee retention credit? This credit is designed to help businesses keep their workforce during the COVID-19 pandemic. In this guide, we'll walk you through the steps of how to check the status of your employee retention credit, so you can make sure you're taking full advantage of this valuable tax credit.

Source: baronpayroll.com

Checking the Status of the Employee Retention Credit

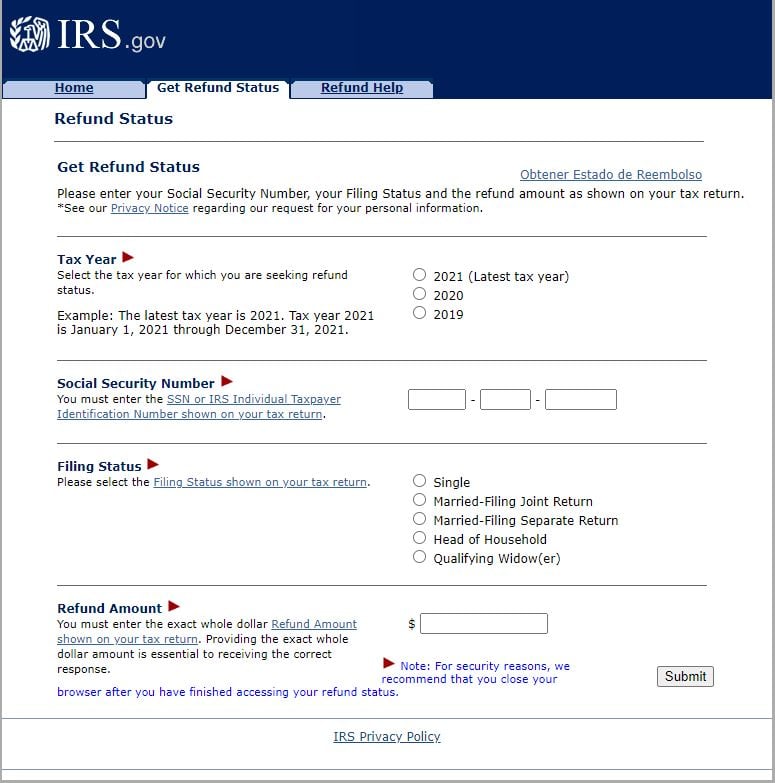

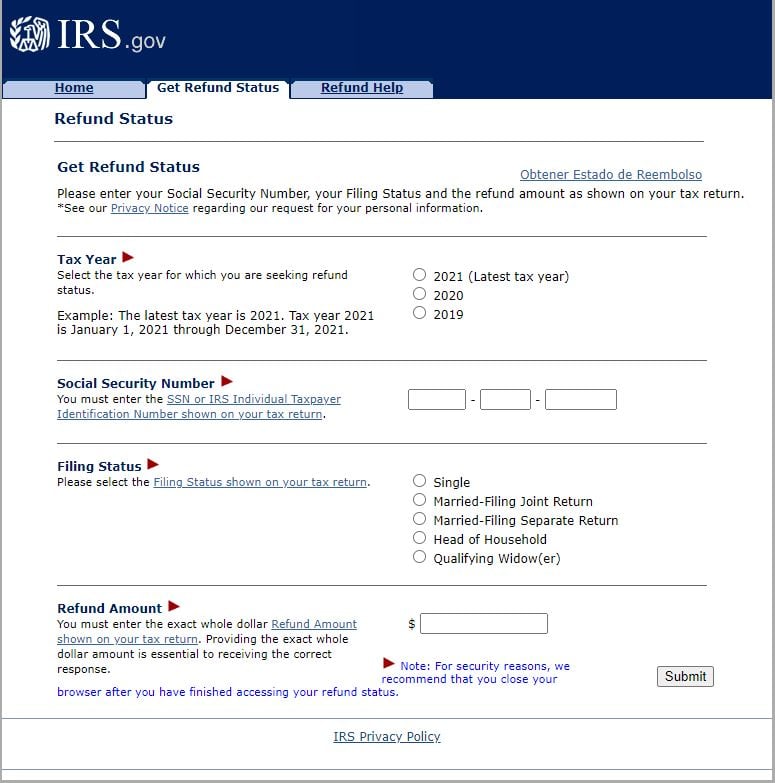

- Go to the IRS website for the Employee Retention Credit.

- Select the option to check the status of the credit.

- Enter the Employer Identification Number (EIN) and the tax period for the credit.

- The website will prompt you to enter an access code.

- Enter the access code and click Submit to view the status of the credit.

What is the Employee Retention Credit?

The Employee Retention Credit (ERC) is a tax credit of up to $5,000 per employee that is available to certain businesses and organizations that have been impacted by the COVID-19 pandemic. The credit is intended to help businesses keep their employees on the payroll and to help alleviate some of the financial burden that businesses have faced due to the pandemic. The ERC was first introduced as part of the CARES Act, which was enacted in March of 2020. Since then, the ERC has been extended and expanded as part of other federal legislation, including the Consolidated Appropriations Act of 2021. The ERC is available to businesses that are experiencing reduced business activity due to the pandemic, as well as to certain non-profit organizations.Who is Eligible for the Employee Retention Credit?

In order to be eligible for the ERC, businesses must meet certain criteria. First, businesses must have seen their gross receipts decline by more than 50 percent when compared to the same period in the prior year. Second, businesses must have fewer than 500 employees. Finally, businesses must have been forced to partially or fully suspend operations due to government orders related to the pandemic. In addition, certain non-profit organizations are eligible for the ERC. Non-profit organizations must have fewer than 500 employees and must have seen their gross receipts decline by more than 15 percent when compared to the same period in the prior year.How to Check Status of Employee Retention Credit?

Step 1: Gather Necessary Documentation

The first step in checking the status of the ERC is to gather all of the necessary documentation. This includes documentation that is related to the business’s revenue for the period in question, as well as documentation that is related to the number of employees that the business had during that period. This documentation should be kept in an organized manner, and should be made available to the IRS upon request.Step 2: Calculate Eligibility

The next step in checking the status of the ERC is to calculate the eligibility of the business. This includes calculating the business’s gross receipts for the period in question, as well as calculating the number of employees that the business had during that period. If the business meets the criteria for eligibility, then the business is eligible for the ERC.Step 3: File Form 941

The final step in checking the status of the ERC is to file Form 941. Form 941 is the form that must be filed with the IRS in order to claim the ERC. This form can be filed electronically, or it can be filed by mail. The form must be filed in order for the business to receive the credit.Step 4: Claim the Credit

Once the business has filed Form 941, the business can then claim the credit. This can be done by filing Form 941-X, which is the form that must be filed to claim the ERC. Once the form is filed, the business can then claim the credit on their tax return.Step 5: Monitor Credit Status

The final step in checking the status of the ERC is to monitor the status of the credit. This can be done by periodically checking the status of the credit on the IRS website, or by contacting the IRS directly. If the credit has been approved, then the business will receive notification from the IRS. If the credit has not been approved, then the business may need to provide additional information to the IRS in order to receive the credit.Related FAQ

What is the Employee Retention Credit?

The Employee Retention Credit (ERC) is a refundable tax credit for employers who retain employees and pay them wages during the COVID-19 pandemic. This credit is available to all employers, regardless of size, who had to close their business or experienced a significant decline in gross receipts due to the pandemic. The credit is equal to 50% of wages paid to employees, up to a maximum of $5,000 per employee, per quarter.How can employers claim the Employee Retention Credit?

Employers can claim the Employee Retention Credit by using Form 941, Employer’s Quarterly Federal Tax Return. The credit can be claimed as a refundable credit against the employer's portion of Social Security taxes. The credit can also be claimed on Form 945, Annual Return of Withheld Federal Income Tax, or Form 1040-X, Amended U.S. Individual Income Tax Return.How to Check Status of Employee Retention Credit?

Employers can check the status of their Employee Retention Credit claim by accessing the Internal Revenue Service (IRS) website. The IRS provides a tool that allows employers to view the status of their claim and any payments that have been made on it. Employers can also call the IRS directly and ask for assistance in obtaining the status of their claim.What information is needed to check the status of the Employee Retention Credit?

To check the status of the Employee Retention Credit, employers will need to provide the following information: their Employer Identification Number (EIN); the tax year for which the credit is being claimed; the form number (Form 941, Form 945, or Form 1040-X); and their Social Security Number (if they are filing Form 945 or Form 1040-X).What if the status of an Employee Retention Credit claim has not been updated?

If the status of an Employee Retention Credit claim has not been updated, employers should contact the IRS directly by phone or through the website. The IRS can provide assistance in obtaining the status of a claim and any payments that have been made on it.What are the rules for claiming the Employee Retention Credit?

In order to claim the Employee Retention Credit, employers must meet certain criteria. They must have been affected by the COVID-19 pandemic, either by closure of their business or by experiencing a significant decline in gross receipts. The credit is equal to 50% of wages paid to employees, up to a maximum of $5,000 per employee, per quarter. The credit is available to employers of all sizes, including nonprofits and government entities.How To Check Employee Retention Credit Refund Status?

The Employee Retention Credit is a powerful tool that can help you reduce the burden of payroll taxes and retain your valuable employees while the economy is still recovering. As a professional writer, I strongly recommend that you take the time to check the status of your Employee Retention Credit to ensure that you are taking full advantage of this program. The process is simple and straightforward, and it could make all the difference in the success of your business.

Balises:

Article précédent

How to Fill Out a 941x for Employee Retention Credit?

Article suivant