How Will I Receive My Employee Retention Credit Refund?

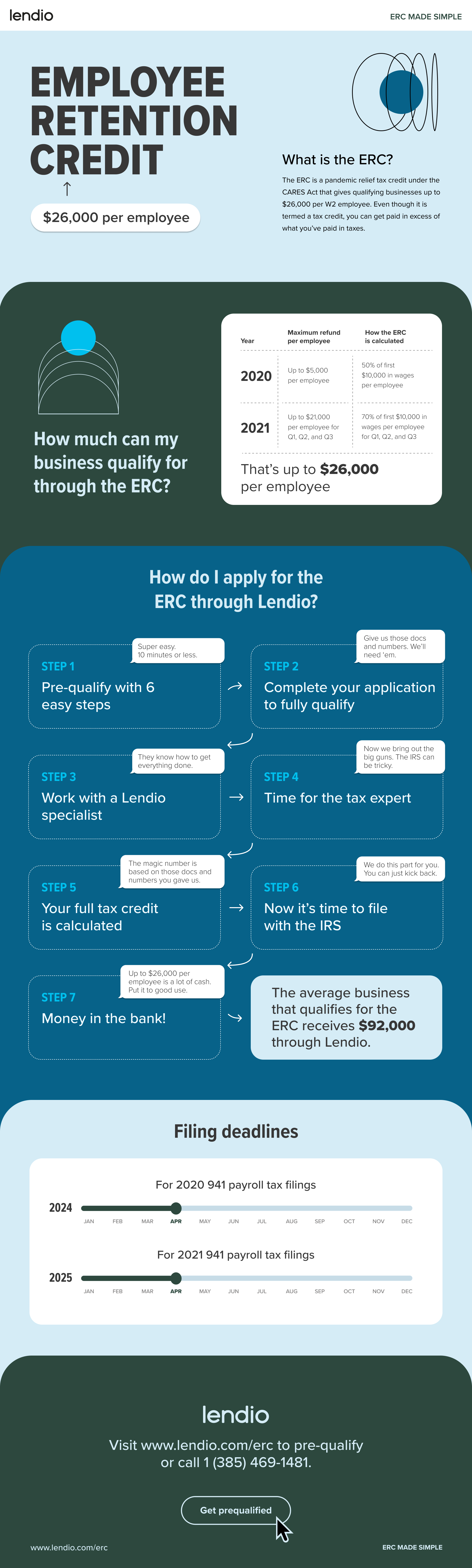

Are you wondering how you can receive your employee retention credit refund? The employee retention credit, which was introduced by the CARES act in 2020, is designed to provide financial relief to businesses during the COVID-19 pandemic. If you have been eligible for the credit, you may be eligible for a refund from the IRS. In this article, we will discuss the process of receiving your employee retention credit refund.

Source: ytimg.com

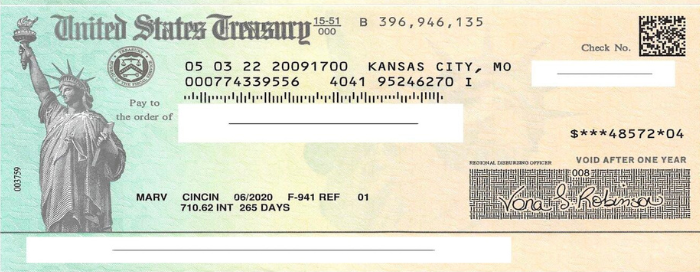

Your employee retention credit refund is available as a refundable tax credit and will be issued via IRS Form 941. To receive your refund, you must include the employee retention credit on your Form 941, and the IRS will issue the refund within 90 days.

How to Receive an Employee Retention Credit Refund

Employee Retention Credits (ERC) are available to employers who have been affected by the COVID-19 pandemic. These credits help businesses offset the cost of retaining their employees by providing them with a refundable tax credit. The amount of the credit is based on qualified wages paid to employees, up to a maximum of $5,000 per employee for each quarter. Employers who qualify for the credit should be aware of the steps involved in claiming the credit and receiving their refund.Check Your Eligibility for the Employee Retention Credit

The first step in receiving an Employee Retention Credit refund is to determine if your company qualifies for the credit. To be eligible, your business must have suffered a full or partial suspension of operations due to governmental orders related to the COVID-19 pandemic, or have experienced a significant decline in gross receipts in 2020. Your business must also have paid qualified wages to its employees during the quarter in which it is claiming the credit.Calculate the Credit Amount

Once you have determined that your business is eligible for the credit, you must calculate the amount of the credit by using the formula provided in the IRS guidelines. This formula takes into account the amount of qualified wages paid to employees and the number of employees on the payroll. You should also take into consideration any tax credits that you may have already claimed for the same wages.Claim the Credit on the Tax Return

The next step is to claim the credit on your business’s tax return. You must fill out Form 941 to report the qualified wages that you paid during the quarter and the amount of the credit that you are claiming. Once you have completed the form, you can file it along with your tax return.Receive Your Refund

Once you have filed your tax return, you can expect to receive your refund within 8-10 weeks. The IRS will send you a notice confirming the amount of the refund that you are due. You will also receive a payment voucher that you can use to claim the refund.Amend Your Tax Return

If you decide to amend your tax return after filing, you can also use the same payment voucher to claim the refund. In order to amend your return, you must complete Form 1040-X and attach the voucher to the form. You should also include any additional documents that are needed to support your claim.Seek Professional Assistance

The process for claiming an Employee Retention Credit refund can be complicated, so it is important to seek professional assistance. Tax professionals can help you determine your eligibility for the credit, calculate the amount of the credit, and file your tax return. They can also help you amend your tax return if needed and ensure that you receive your refund in a timely manner.Related FAQ

Q1. How does the Employee Retention Credit work?

A1. The Employee Retention Credit is a refundable tax credit for employers who are subject to either a full or partial suspension of operations due to a COVID-19 related shut-down order or a significant decline in gross receipts. Employers can receive a tax credit of up to $5,000 for each eligible employee who is paid wages for wages paid after March 12, 2020, and before January 1, 2021. The credit is equal to 50% of the qualified wages paid to an eligible employee, up to a maximum of $10,000 in qualified wages per employee. The credit can be claimed on the employer’s quarterly payroll tax filings, or through an advance payment program.Q2. How will I receive my Employee Retention Credit refund?

A2. The Employee Retention Credit refund is received in one of two ways. If the employer has elected to receive an advance payment of the credit, the advance payment will be refunded in the form of a credit against the employer’s payroll taxes. Alternatively, if the employer has elected to claim the credit on its quarterly payroll tax filings, the refund will be in the form of an offset against the employer’s payroll taxes.Q3. How will the IRS know I am eligible for the credit?

A3. The IRS will review the employer’s quarterly payroll tax filings to ensure that the employer meets the eligibility requirements for the credit. The employer must also provide documentation to the IRS that shows that the business was either subject to a full or partial suspension of operations due to a COVID-19 related shut-down order, or that the business experienced a significant decline in gross receipts.Q4. When can I expect to receive my Employee Retention Credit refund?

A4. The timing of the refund depends on the method chosen by the employer. If the employer elects to receive an advance payment of the credit, the employer should expect to receive the refund within two weeks of filing the request. If the employer elects to claim the credit on its quarterly payroll tax filings, the refund will be processed within two weeks of filing the quarterly return.Q5. Are there any restrictions on how I can use the Employee Retention Credit refund?

A5. Yes, the Employee Retention Credit refund must be used to cover qualified wages paid to eligible employees, or to cover other associated costs, such as health care costs, paid as part of the employer’s payroll tax filings.Q6. Are there any limits to the amount of Employee Retention Credit refund I can receive?

A6. Yes, the maximum amount of the credit is $5,000 per eligible employee, up to a maximum of $10,000 in qualified wages per employee. The total amount of the credit cannot exceed $5,000 multiplied by the number of eligible employees. In addition, the total amount of credit for which an employer can claim is limited to the amount of the employer’s payroll taxes for the calendar year.(ERC) Employee Retention Credit Processing Times - How Long To Get ERC Refund?

In conclusion, the Employee Retention Credit refund can be a great way to help businesses recover after a difficult period of financial hardship. Depending on the size and eligibility of your company, the refund can be substantial and can be received in a variety of ways. Knowing how to receive your refund and taking the proper steps to ensure that it is processed correctly is essential. With the help of tax professionals and an understanding of the rules and regulations, you can make sure that you receive your refund in a timely and efficient manner.

Tags:

Previous post

When Will Employee Retention Credit Checks Be Mailed?

Next post