How to Check Employee Retention Credit Status?

Retaining employees is essential for businesses to remain competitive and successful, and is an important part of any human resource management strategy. As an employer, it is important to understand and keep track of employee retention credit status. Improving employee retention can lead to a more productive and satisfied workforce. In this article, we will discuss how to check employee retention credit status and the benefits of doing so.

Checking the Employee Retention Credit Status

- Open the IRS website and find the Employee Retention Credit page.

- Create an account with the IRS if you don't have one.

- Navigate to the Form 941 page.

- Find the Employee Retention Credit section of the form.

- Enter your business's information including your Employer Identification Number.

- Submit the form to the IRS. They will let you know if you are eligible for the Employee Retention Credit.

What is the Employee Retention Credit?

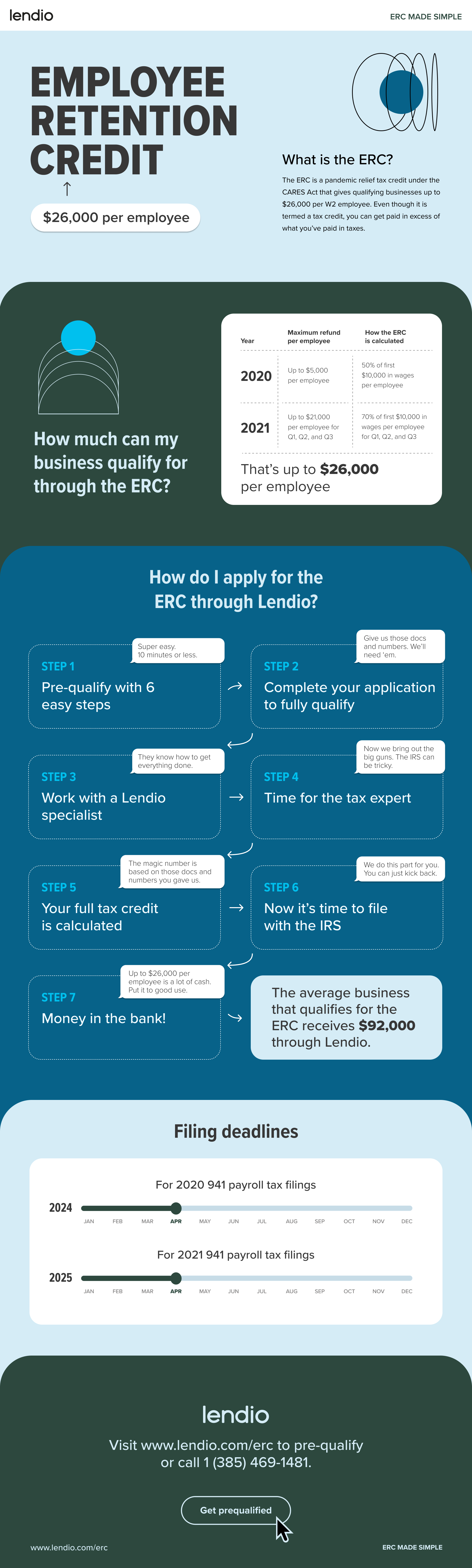

The Employee Retention Credit (ERC) is a refundable tax credit created under the CARES Act in March 2020 to help employers struggling with the financial impacts of the COVID-19 pandemic. It provides eligible employers with a credit against their Social Security taxes for wages paid to employees between March 13, 2020 and December 31, 2020. The credit is calculated as a percentage of each employee's wages up to a maximum of $5,000 per employee. The amount of the credit depends on a variety of factors, including the size of the employer and the amount of wages paid to employees. Employers may be eligible for up to 70% of qualified wages paid to employees, up to a maximum of $5,000 per employee. Employers can claim the credit if they are experiencing a full or partial suspension of their business operations due to COVID-19 or if they have experienced a significant decline in gross receipts.Eligibility Requirements for Employee Retention Credit

In order to be eligible to claim the Employee Retention Credit, an employer must meet certain eligibility requirements. Employers must have a full or partial suspension of operations due to government orders related to COVID-19, or experience a significant decline in gross receipts. In addition, employers must have fewer than 500 full-time employees in order to qualify. Full-time employees are defined as those who work at least 30 hours per week or 130 hours per month. Employers with 500 or more full-time employees may still be eligible for the credit if they meet certain criteria. Employers must also ensure that wages paid to employees are not taken into account for any other credits or deductions, such as the Work Opportunity Tax Credit or the Family and Medical Leave Credit.Calculating the Employee Retention Credit

The Employee Retention Credit is calculated as a percentage of qualified wages paid to employees, up to a maximum of $5,000 per employee. The amount of the credit depends on the size of the employer and the amount of wages paid to employees. For employers with 100 or fewer employees, the credit is equal to 70% of qualified wages paid to each employee, up to a maximum of $5,000 per employee. For employers with more than 100 employees, the credit is equal to 50% of qualified wages paid to each employee, up to a maximum of $5,000 per employee. Employers may also be eligible for additional credits if they are able to retain employees and pay them at least 50% of their regular wages.Claiming the Employee Retention Credit

To claim the Employee Retention Credit, employers must file Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund. Employers must also include Form 941-X with their regular quarterly Form 941 filing. In addition, employers must attach a statement to Form 941-X that includes the total amount of the credit claimed, the amount of the credit from the prior quarter, and the amount of wages paid to each employee for which the credit is claimed.Documentation Requirements for Employee Retention Credit

In order to claim the Employee Retention Credit, employers must maintain adequate records of the credit calculations and supporting documents. These documents include payroll records, copies of Form 941-X, and other documents related to the credit calculation. Employers must also retain copies of the documents used to support the credit calculation, such as payroll records, copies of Form 941-X, and other documents related to the credit calculation.Conclusion

The Employee Retention Credit is a refundable tax credit created under the CARES Act in March 2020 to help employers struggling with the financial impacts of the COVID-19 pandemic. Eligible employers can claim the credit if they are experiencing a full or partial suspension of their business operations due to COVID-19 or if they have experienced a significant decline in gross receipts. The amount of the credit depends on a variety of factors, including the size of the employer and the amount of wages paid to employees. Employers must file Form 941-X and attach a statement to the form to claim the credit. In addition, employers must maintain adequate records of the credit calculations and supporting documents and retain copies of the documents used to support the credit calculation.Related FAQ

What is Employee Retention Credit?

Employee Retention Credit (ERC) is a tax credit designed to help employers who have been affected by the COVID-19 pandemic. It was created as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, and it allows employers to receive a tax credit of up to $5,000 per employee for wages paid from March 13, 2020 through December 31, 2020. The credit is based on a percentage of wages paid to each employee during the applicable period.Who is Eligible for Employee Retention Credit?

Employers are eligible for the Employee Retention Credit if they have experienced a full or partial suspension of their operations due to government orders related to COVID-19, or if their gross receipts have declined by more than 50% compared to the same quarter in the prior year.How to Calculate Employee Retention Credit?

The amount of the credit is equal to 50% of qualified wages paid to an employee, up to a maximum of $5,000 per employee. Qualified wages are wages paid after March 12, 2020 and before January 1, 2021.How to Claim Employee Retention Credit?

Employers can claim the Employee Retention Credit by filing Form 941, Employer's Quarterly Federal Tax Return, or Form 944, Employer's Annual Federal Tax Return. On Form 941, employers should complete and file Schedule R, which is used to calculate the amount of the credit.What Forms Need to be Filled Out to Check Employee Retention Credit Status?

The form that must be filled out to check the Employee Retention Credit status is Form 941, Employer's Quarterly Federal Tax Return, or Form 944, Employer's Annual Federal Tax Return. As part of these forms, employers should complete and file Schedule R, which is used to calculate the amount of the credit.How to Check Employee Retention Credit Status?

Employers can check the status of their Employee Retention Credit by accessing the IRS website. On the website, employers should select the "Find My Refund" option and enter the information required. The website will then provide information on the status of the credit, including when the credit was processed and when the funds were deposited. Employers can also check the status of their credit by calling the IRS toll-free customer service number.How To Check Employee Retention Credit Refund Status?

Employee retention credit status is a key indicator of an organization's success. By regularly checking employee retention credit status, employers can ensure that their employees are happy and productive, and that their organization is running smoothly. Checking employee retention credit status is also important for tracking employee performance and morale. With the right tools and processes in place, employers can easily access this valuable information and use it to make smart decisions regarding their workforce. With the right knowledge, employers can ensure they are providing their employees with the support they need to stay motivated and successful.

Tags:

Previous post

Is the Employee Retention Credit Legitimate?

Next post