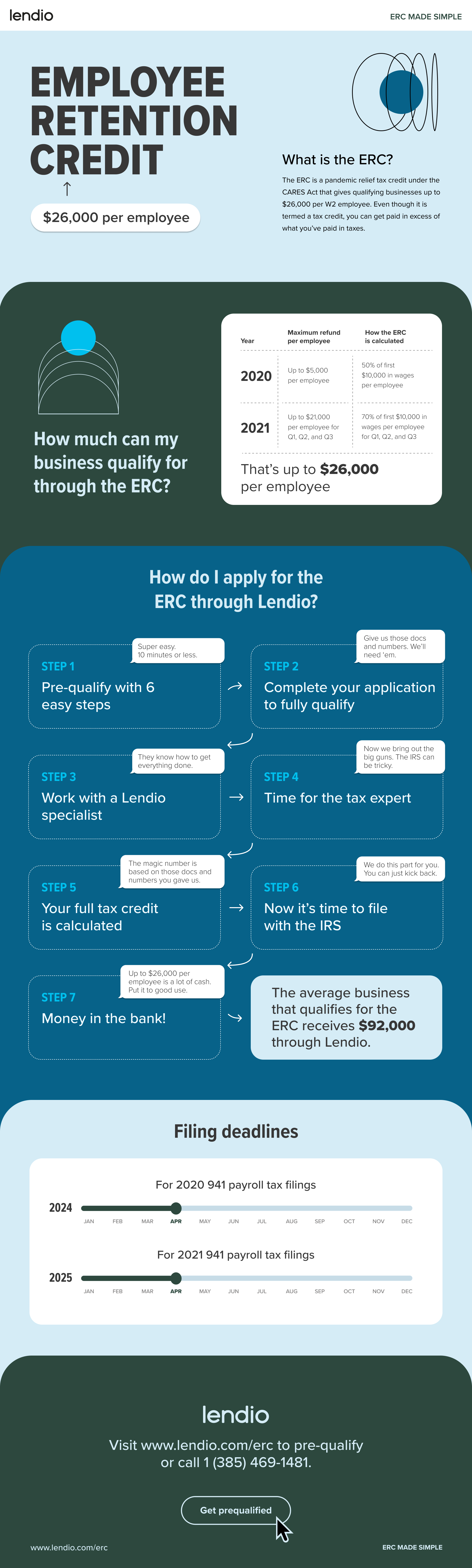

The 7-Step Employee Retention Tax Credit Calculation Worksheet

As any business knows, employee retention is key to success. But when it comes to calculating employee retention tax credit, the process can be complicated. That's why we've developed this 7-step Employee Retention Tax Credit Calculation Worksheet. This worksheet will walk you step-by-step through the process of calculating your employee retention tax credit and ensure that you get the maximum benefit from the tax credit.

Source: erctoday.com

Source: hubspotusercontent-na1.net

Employee Retention Tax Credit How to Determine Your Credit

Employee retention is essential for the success of any organization. By utilizing the 7-Step Employee Retention Tax Credit Calculation Worksheet, you can quickly and easily assess the value of a tax credit for your company. This worksheet helps to ensure that your organization will receive the highest possible credit for employee retention. By taking advantage of this tax credit, your business can save money and stay competitive in the marketplace. Investing in employee retention is an important part of keeping your business successful and profitable.

The 7-Step Employee Retention Tax Credit Calculation Worksheet is designed to help employers calculate and apply for the Employee Retention Tax Credit (ERTC). This worksheet walks employers through the process of determining eligibility, calculating the credit, and submitting the application. It includes important details about the program, such as eligible wages and how the credit is applied. This worksheet can help ensure employers are eligible for the ERTC and maximize their tax savings.

What is the 7-Step Employee Retention Tax Credit Calculation Worksheet?

The 7-Step Employee Retention Tax Credit Calculation Worksheet is a tool created by the Internal Revenue Service (IRS) to help business owners calculate their employee retention tax credit, a type of tax credit available to businesses affected by the COVID-19 pandemic. The worksheet helps business owners determine their eligibility for the credit, as well as the amount of the credit for which they are eligible. The Employee Retention Tax Credit is a tax credit that is available to businesses affected by the pandemic. This credit is equal to 50% of qualified wages paid to employees between January 1, 2020 and June 30, 2021. The maximum credit is $10,000 per employee per year. To be eligible for the credit, a business must have experienced an income reduction of at least 20% in either 2020 or 2021 compared to the previous year.How to Use the 7-Step Employee Retention Tax Credit Calculation Worksheet

The 7-Step Employee Retention Tax Credit Calculation Worksheet is designed to help business owners calculate the amount of the credit they are eligible to receive. The worksheet consists of seven steps, which are outlined below:Step 1: Calculate Eligible Wages

The first step is to calculate the amount of eligible wages paid to employees in 2020 or 2021. Eligible wages include wages paid to employees for services performed between January 1, 2020 and June 30, 2021. This includes wages paid for time off due to reduced hours or closure of the business.Step 2: Calculate Creditable Wages

The next step is to calculate the amount of creditable wages. Creditable wages are the amount of eligible wages that can be used to calculate the credit. The maximum amount of creditable wages that can be used to calculate the credit is $10,000 per employee per year.Step 3: Calculate Qualified Wages

The third step is to calculate the amount of qualified wages. Qualified wages are the amount of creditable wages that can be used to calculate the credit. To be eligible, the wages must be paid between March 13, 2020 and June 30, 2021. The maximum amount of qualified wages that can be used to calculate the credit is $10,000 per employee per year.Step 4: Calculate the Credit Amount

The fourth step is to calculate the amount of the credit. The credit is equal to 50% of the qualified wages paid to employees. The maximum credit is $10,000 per employee per year.Step 5: Determine Eligibility

The fifth step is to determine eligibility for the credit. To be eligible, a business must have experienced an income reduction of at least 20% in either 2020 or 2021 compared to the previous year.Step 6: Claim the Credit

The sixth step is to claim the credit. The credit can be claimed on the business’s income tax return.Step 7: Calculate the Adjusted Tax Liability

The seventh and final step is to calculate the adjusted tax liability. This is the amount of taxes that the business is liable for after taking into account the tax credit.Frequently Asked Questions

What is the 7-Step Employee Retention Tax Credit Calculation Worksheet?

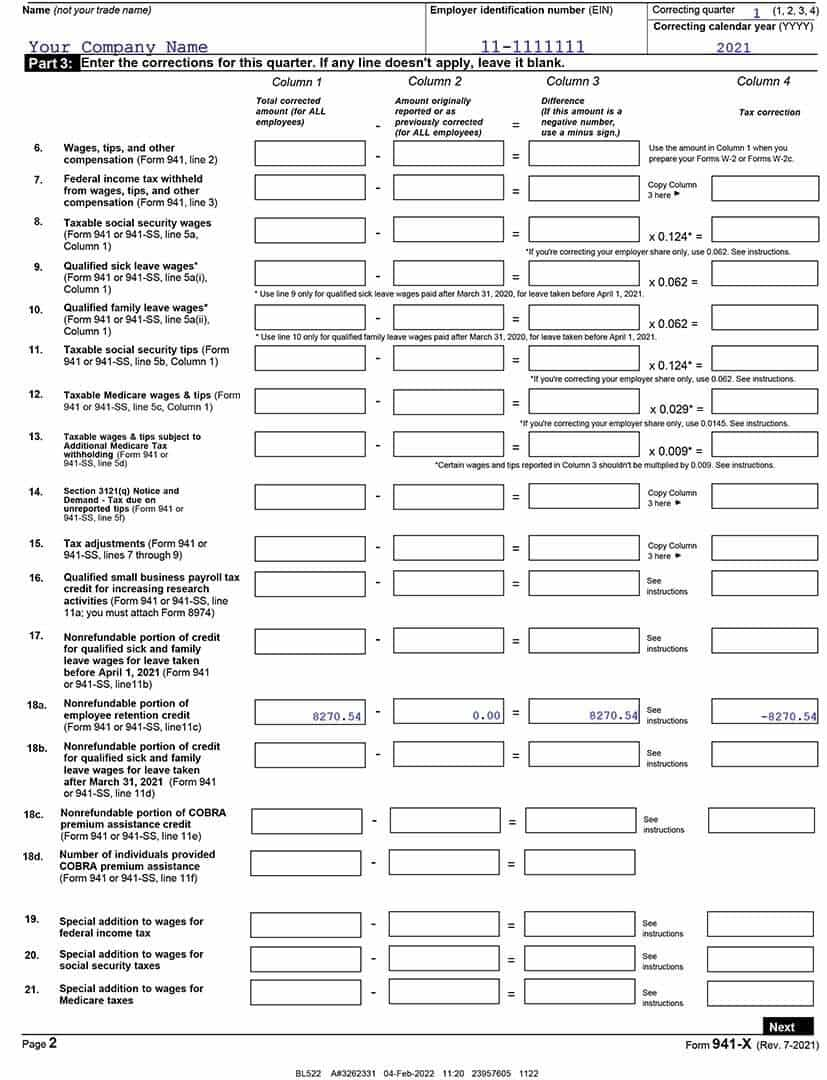

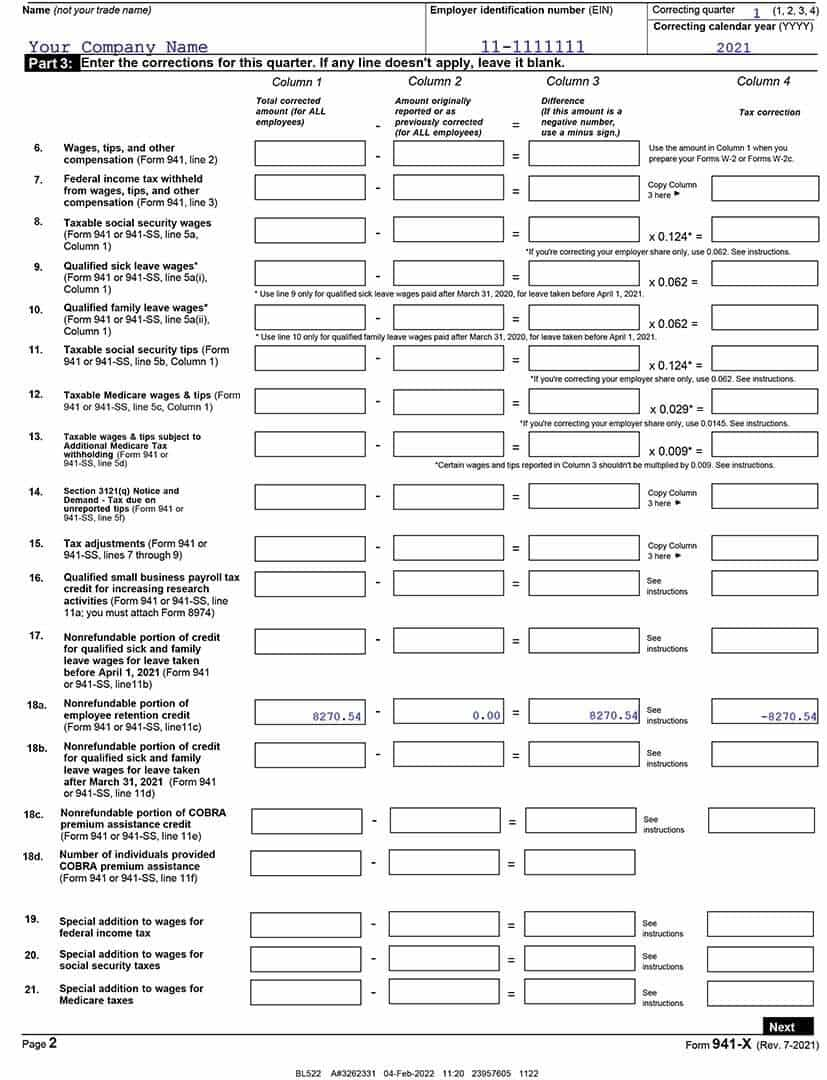

The 7-Step Employee Retention Tax Credit Calculation Worksheet is a tool used to calculate the eligible amount of an Employee Retention Tax Credit (ERTC) for businesses affected by the Coronavirus pandemic. It is designed as a step-by-step worksheet to help businesses calculate their ERTC amount, which is then used to claim the credit on Form 941.What is the purpose of the 7-Step Employee Retention Tax Credit Calculation Worksheet?

The purpose of the 7-Step Employee Retention Tax Credit Calculation Worksheet is to help businesses calculate the amount of their ERTC to claim on Form 941. It is designed to provide an easy and accurate way to calculate the eligible amount of the credit.How is the 7-Step Employee Retention Tax Credit Calculation Worksheet structured?

The 7-Step Employee Retention Tax Credit Calculation Worksheet is divided into seven steps. Each step includes instructions and an example calculation to help businesses understand and calculate their ERTC amount. The seven steps are: Step 1 - Determine the Relevant Payroll Periods, Step 2 - Calculate Qualified Wages (QW), Step 3 - Calculate Eligible Employer Payment (EEP), Step 4 - Calculate Maximum ERTC Amount, Step 5 - Calculate Adjusted ERTC Amount, Step 6 - Claim the ERTC, and Step 7 - Report ERTC on Form 941.Who is eligible to use the 7-Step Employee Retention Tax Credit Calculation Worksheet?

Businesses that have been affected by the Coronavirus pandemic are eligible to use the 7-Step Employee Retention Tax Credit Calculation Worksheet to calculate their ERTC amount. This includes businesses that have had to close, reduce wages or hours, or have seen a significant decline in gross receipts.What information is needed to use the 7-Step Employee Retention Tax Credit Calculation Worksheet?

In order to use the 7-Step Employee Retention Tax Credit Calculation Worksheet, businesses need to have the following information: their total wages paid during relevant payroll periods, the total number of employees, and the total amount of qualified wages paid during the relevant payroll periods.How is the ERTC claimed?

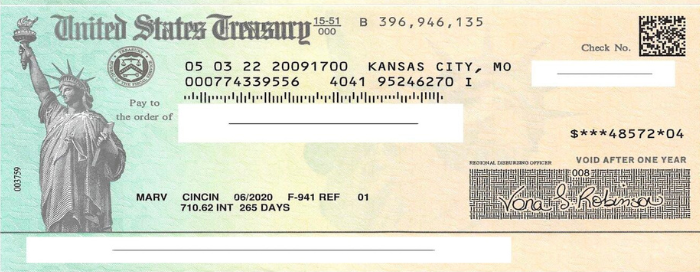

The ERTC is claimed on Form 941. Businesses must fill out Form 941 and include the total ERTC amount they are eligible for. The ERTC amount must be calculated using the 7-Step Employee Retention Tax Credit Calculation Worksheet. Once Form 941 is completed, businesses can submit it to the IRS to claim their ERTC.

Employee Retention Tax Credit How to Determine Your Credit

Employee retention is essential for the success of any organization. By utilizing the 7-Step Employee Retention Tax Credit Calculation Worksheet, you can quickly and easily assess the value of a tax credit for your company. This worksheet helps to ensure that your organization will receive the highest possible credit for employee retention. By taking advantage of this tax credit, your business can save money and stay competitive in the marketplace. Investing in employee retention is an important part of keeping your business successful and profitable.

Tags:

Previous post

When Will Employee Retention Credit Checks Be Mailed?

Next post