Do You Have to Amend Tax Return for Erc Credit?

As a taxpayer, it is important to understand all of your available tax credits and deductions. With the Economic Recovery Credit (ERC) being one of the more recently introduced tax credits in the United States, it is essential to understand when and how to utilize it. This article will help you understand if you need to amend your tax return for the ERC credit. We will discuss the purpose of the ERC credit, when you need to amend your tax return for it, and how to go about doing so.

Source: hubspotusercontent-na1.net

Update: 2021 Reporting ERTC & Sick Leave Tax Credits on Tax Return

When it comes to amending tax returns for the ERC Credit, the answer is yes. As a professional writer, I can tell you that it’s important to understand your rights and responsibilities as a taxpayer when it comes to filing and amending your tax returns. Taking the time to understand the rules and regulations related to the ERC Credit can help you maximize your tax benefits and save money in the long run. So, if you're eligible, don't forget to amend your tax return and take advantage of the ERC Credit.

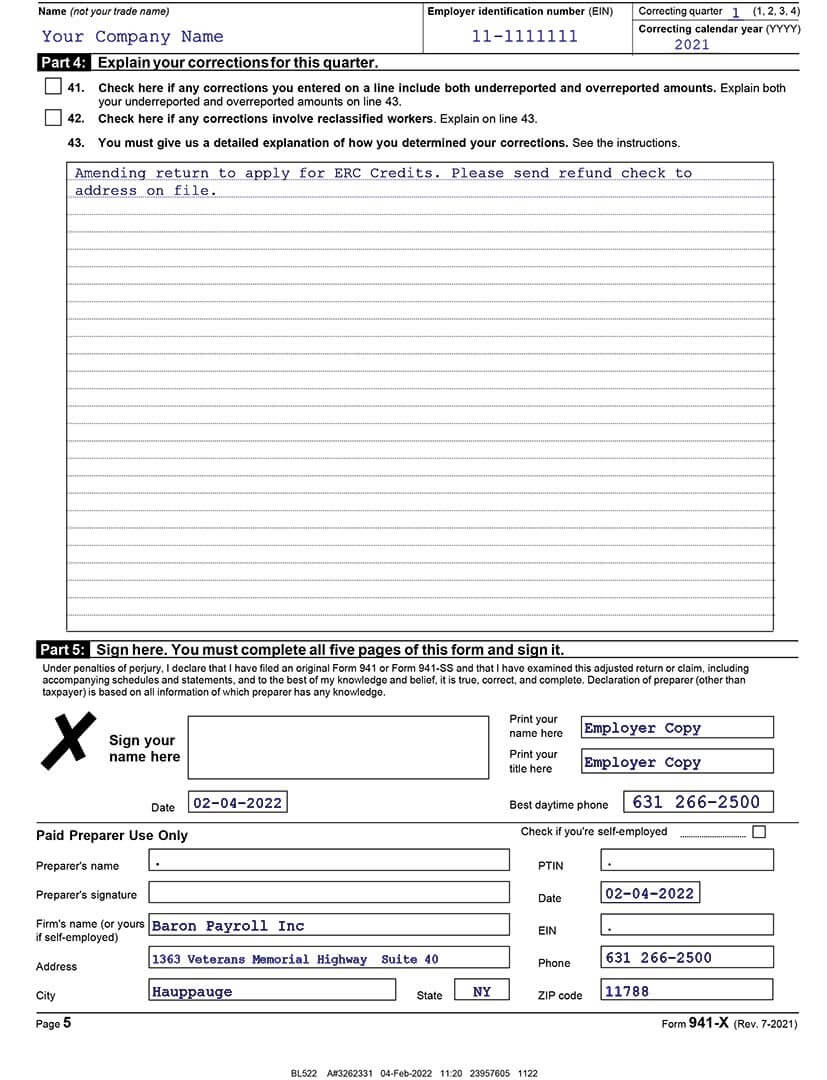

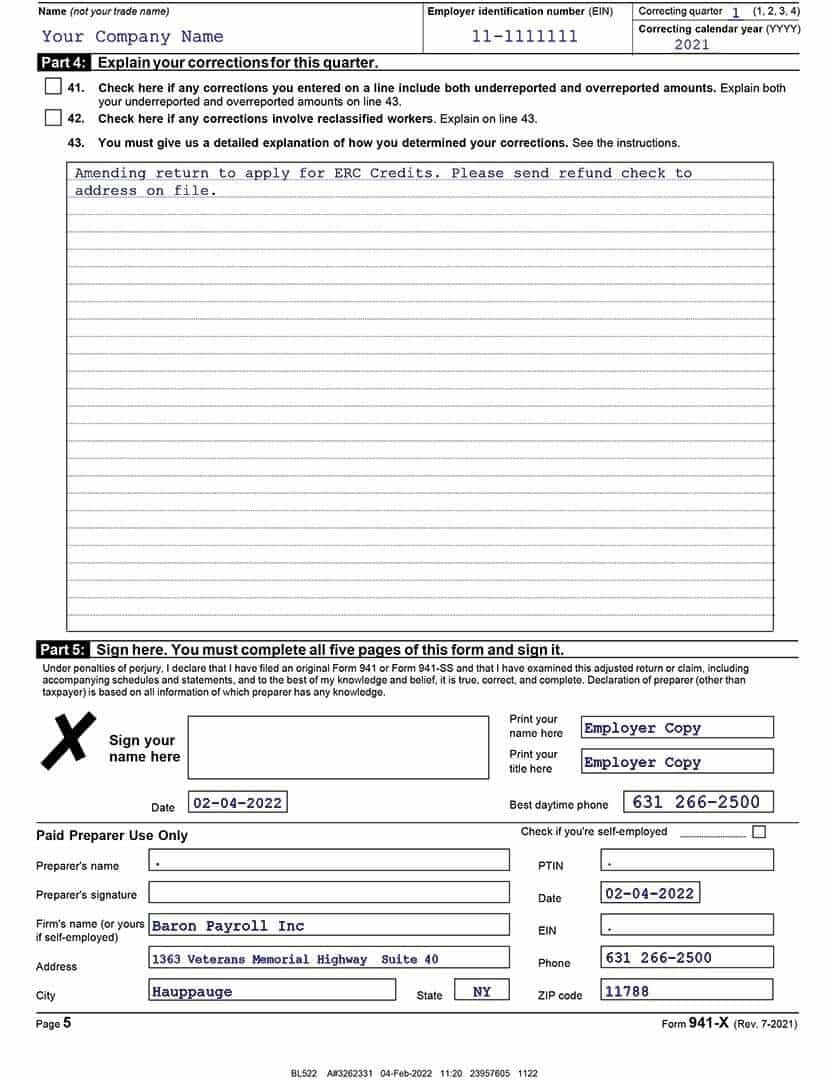

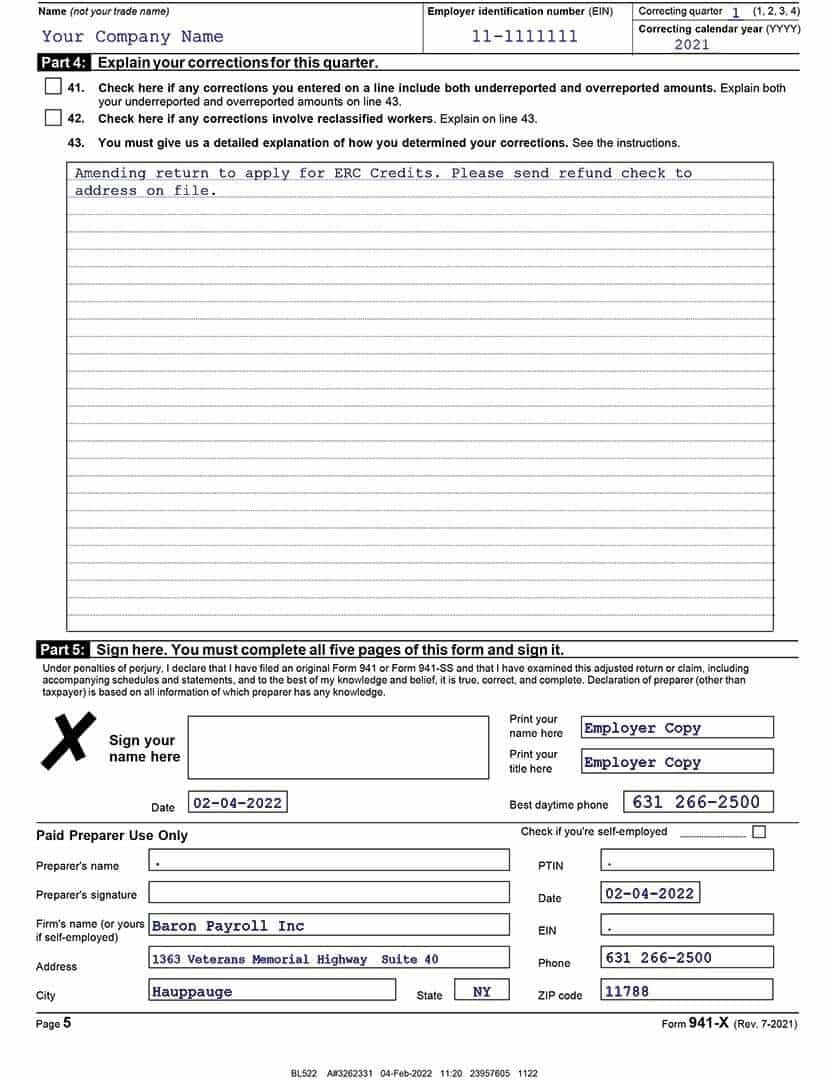

Yes, you must amend your tax return to claim the Employee Retention Credit (ERC). To amend your return, you will need to submit Form 941X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. This form can be found on the IRS website. You will need to include the amount of the ERC you are claiming, proof of eligibility, and other information.

Do You Need to Amend Your Tax Returns for the Employee Retention Credit?

The Employee Retention Credit (ERC) is a refundable tax credit available to certain employers who were impacted by the COVID-19 pandemic. The credit is equal to 50% of up to $10,000 of qualified wages paid to each employee, up to a maximum of $5,000 per employee. The credit is available for wages paid from March 13, 2020 through December 31, 2020. If you have already filed your taxes for 2020, you may need to file an amended return to claim the ERC. The IRS has indicated that you may claim the credit on either your original or amended return. In order to claim the credit, you must file Form 941, Employer’s Quarterly Federal Tax Return, for the appropriate quarter. The credit can then be claimed on the corresponding Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund.Who Is Eligible for the ERC?

The ERC is available to employers whose businesses have been impacted by the COVID-19 pandemic. This includes employers whose operations were either fully or partially suspended as a result of a government order related to the pandemic or whose gross receipts declined by more than 50% compared to the same quarter in the prior year. The credit is also available to employers who received a Small Business Interruption Loan (PPP) and employers who received an Economic Injury Disaster Loan (EIDL). In order to be eligible for the credit, employers must have been in business for at least one quarter prior to the applicable quarter for which the credit is being claimed. Employers must also have paid qualified wages to their employees during the applicable quarter. Qualified wages are wages paid to an employee for services performed, up to the applicable limit of $10,000 per employee per quarter.How Can I Claim the Credit?

In order to claim the ERC, employers must file Form 941, Employer’s Quarterly Federal Tax Return, for the appropriate quarter. The credit can then be claimed on the corresponding Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund. The IRS has indicated that employers can claim the credit on either their original or amended return. If you have already filed your taxes for 2020, you may need to file an amended return to claim the ERC.What Documentation Do I Need to Claim the Credit?

In order to claim the credit, employers must have documentation to support the wages paid to their employees during the applicable quarter. Employers must also have documentation to support the amount of the credit being claimed. The IRS has indicated that employers must maintain records to support the amount of wages paid and the number of employees to whom the wages were paid. These records must include the name, address, and taxpayer identification number of each employee, and the amount and date of the wages paid.Are There Any Other Considerations?

Employers should be aware that the ERC is not available to employers who receive a Paycheck Protection Program (PPP) loan. Employers who receive a PPP loan must wait until the loan is forgiven before claiming the ERC. Additionally, employers should keep in mind that the ERC is a refundable tax credit. This means that if the credit is greater than the taxes owed, the employer can receive a refund for the difference.Related FAQ

What is an ERC Credit?

An ERC Credit is an Employment Retention Credit. It is a tax incentive created by the CARES Act in 2020 meant to help businesses retain their employees during the COVID-19 pandemic. The credit is available to businesses that experienced a full or partial suspension of operations due to governmental orders related to the pandemic, or experienced a significant decline in gross receipts for a given quarter. The credit allows employers to reduce their federal employment taxes by up to 50% of qualified wages up to $10,000, for a maximum credit of $5,000 per employee.Do You Have to Amend Tax Return for ERC Credit?

Yes, employers must amend their tax return in order to claim the ERC credit. The amendment must be filed on Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund. This form must be filed separately from the employer's quarterly Form 941. Employers must fill out Form 941-X in order to claim the credit and they must also attach a statement to their amended return that explains how the credit was calculated and how the wages and qualified health plan expenses were used to calculate the credit.Who is Eligible to Claim the ERC Credit?

The ERC Credit is available to businesses that experienced a full or partial suspension of operations due to governmental orders related to the COVID-19 pandemic, or experienced a significant decline in gross receipts for a given quarter. Businesses must have experienced either a full or partial suspension of operations, or a significant decline in gross receipts, in order to be eligible for the credit. Additionally, businesses must have paid their employees during the eligible period and have paid employer’s share of FICA taxes on those wages.When Can the ERC Credit be Claimed?

The ERC Credit can be claimed on the employer’s quarterly Form 941, when employers file and pay their federal employment taxes. This credit can be claimed for wages paid between March 13, 2020 and December 31, 2020.What is the Maximum Credit Amount?

The maximum credit amount is $5,000 per employee, with a maximum of $10,000 of qualified wages per employee. This credit is only available for wages paid between March 13, 2020 and December 31, 2020, and employers must have paid their employer’s share of the FICA taxes on those wages.How is the Credit Calculated?

The credit is calculated by taking 50% of the qualified wages paid to employees during the eligible period, up to a maximum of $10,000 per employee. The credit is then limited to the employer’s share of the FICA taxes paid on those wages, not including any portion of the FICA taxes that was paid for by the employee. The credit can be used to offset the employer’s share of the FICA taxes paid in the quarter in which the wages were paid, or in the next quarter.Update: 2021 Reporting ERTC & Sick Leave Tax Credits on Tax Return

When it comes to amending tax returns for the ERC Credit, the answer is yes. As a professional writer, I can tell you that it’s important to understand your rights and responsibilities as a taxpayer when it comes to filing and amending your tax returns. Taking the time to understand the rules and regulations related to the ERC Credit can help you maximize your tax benefits and save money in the long run. So, if you're eligible, don't forget to amend your tax return and take advantage of the ERC Credit.

Tags:

Previous post

Is the Employee Retention Credit Legitimate?

Next post